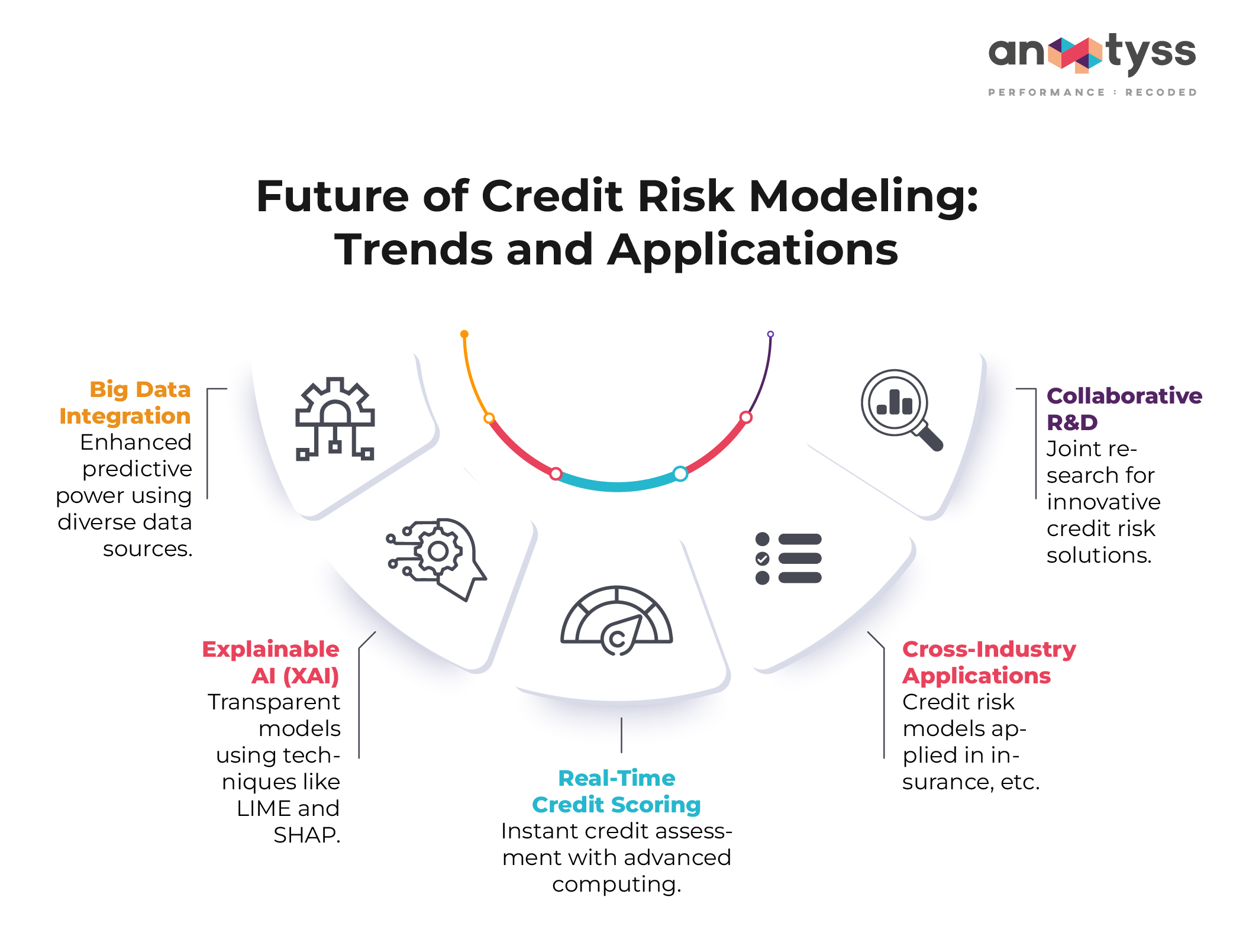

Artificial intelligence and machine learning are transforming credit risk modeling with big data analytics, explainable AI, real-time credit scoring, cross-industry applications, and collaborative R&D, enhancing accuracy and efficiency.

The future of credit risk modeling is continuously evolving with the ever-increasing integration of artificial intelligence and machine learning. These technologies are enabling the development of sophisticated models that can handle huge amounts of data and make accurate predictions. Here are some of the key trends and applications shaping the future of credit risk modeling.

1. Integration of Big Data

Big data analytics increases the prediction capabilities of credit risk models. It allows ingestion and analysis of huge volumes of big data from different sources, such as social media and transaction records, to enhance the model’s accuracy.

Big data analytics has revolutionized credit risk modeling, making it highly predictive. According to a 2023 study by the International Data Corporation (IDC), the global big data and business analytics market is expected to reach $274.3 billion by 2026.

However, as the use of big data in credit risk modeling grows, there will be a necessity for robust frameworks and technologies to keep data private and secure sensitive information in compliance with data protection regulations.

2. XAI (Explainable AI)

As the models get very complicated, the explainability of the models is very important to overcome the “black-box” problem with AI. Techniques such as Local Interpretable Model-agnostic Explanations (LIME), Explain Like I’m 5 (ELI5), and Shapley Additive Explanations (SHAP) are being used to interpret the decisions and working of ML models to make them transparent and interpretable.

Gartner predicts that by 2025, 75% of large organizations will hire AI behavior forensic, privacy, and customer trust specialists to reduce brand and reputation risk.

3. Real-Time Credit Scoring

Real-time credit scoring is now possible with more computational power and faster data processing due to technologies such as quantum computing. With this, financial institutions can assess credit risks in a few seconds and ensure dynamic and responsive decision-making.

MarketsandMarkets reports that the quantum computing market is expected to grow from $472 million in 2021 to $1.76 billion by 2026.

4. Cross-Industry Applications

Credit risk modeling methodologies are gaining adoption in cross-industrial applications. For instance, in insurance, the same models have been used for predicting claim defaults and fraud. In this way, the flexibility and applicability of the methods can be seen.

5. Collaborative Research and Development

The continued cooperation between banks and other financial institutions, academia, law enforcement, and regulatory bodies will be essential to fostering new ideas in the credit risk modeling business. Joint research and exchange of knowledge forums will result in further development of the discipline as well as solving emerging problems.

A McKinsey report highlights that partnerships between financial institutions and technology firms are essential for leveraging advanced analytics and AI.

Conclusion

AI and ML integration in credit risk modeling promises improved accuracy and efficiency. By focusing on big data, explainable AI, real-time scoring, cross-industry applications, and collaborative R&D, financial institutions can stay ahead in credit risk management. At Anaptyss, we offer advanced solutions for credit risk management, including intelligent digital solutions for highly predictive models. Our expertise in financial modeling, risk management, and regulatory compliance enables practical and tailored solutions to manage credit risks and enhance financial institutions’ decision-making and operational efficiency.

To learn more, write to us at: info@anaptyss.com