In this blog, we explore how predictive modeling can revolutionize the Next Best Offer (NBO) strategy in financial services. By harnessing customer data, banks can craft personalized offers that increase engagement, improve conversion rates, and boost customer retention. Predictive analytics allows for the detailed understanding of customer preferences and timely offer customization, enhancing both customer experience and revenue. We discuss the implementation steps, from data collection to the delivery of personalized offers, illustrating how financial institutions can leverage these insights for strategic advantage.

Predictive modeling has found numerous applications in financial services, such as forecasting loan delinquencies, fraud occurrences, customer churn rates, market trends, and more.

Among such many applications, Next Best Offer (NBO)—i.e., creating highly relevant and timely offers for customers—is an emerging use case of predictive modeling in financial services. Predictive modeling and analytics techniques can help financial institutions, including banks, derive actional insights from customer data, allowing them to craft converting offers.

This blog discusses how banks and financial institutions can use predictive modeling for Next Best Offer (NBO), increasing customer experience, revenue, and retention.

What is Next-Best Offer?

Next-Best Offer, or next-best action, is a personalized marketing strategy based on predictive modeling and analysis. For an effective NBO, banks and financial institutions must understand customers’ needs and create optimal product and service offers based on sales, transactions, behavioral patterns, time relevance, and other factors.

Effectively designed next-best offers can facilitate purchase actions from customers who are considering buying.

Predictive modeling is crucial in the NBO value chain, from determining customer needs and preferences and crafting offers to driving consideration and purchase. Aside from allowing a data-led understanding of customers, it helps personalize and guide customer engagement efforts, which is crucial in modern financial services. This approach can help financial institutions boost sales and retention and onboard consumers more effectively.

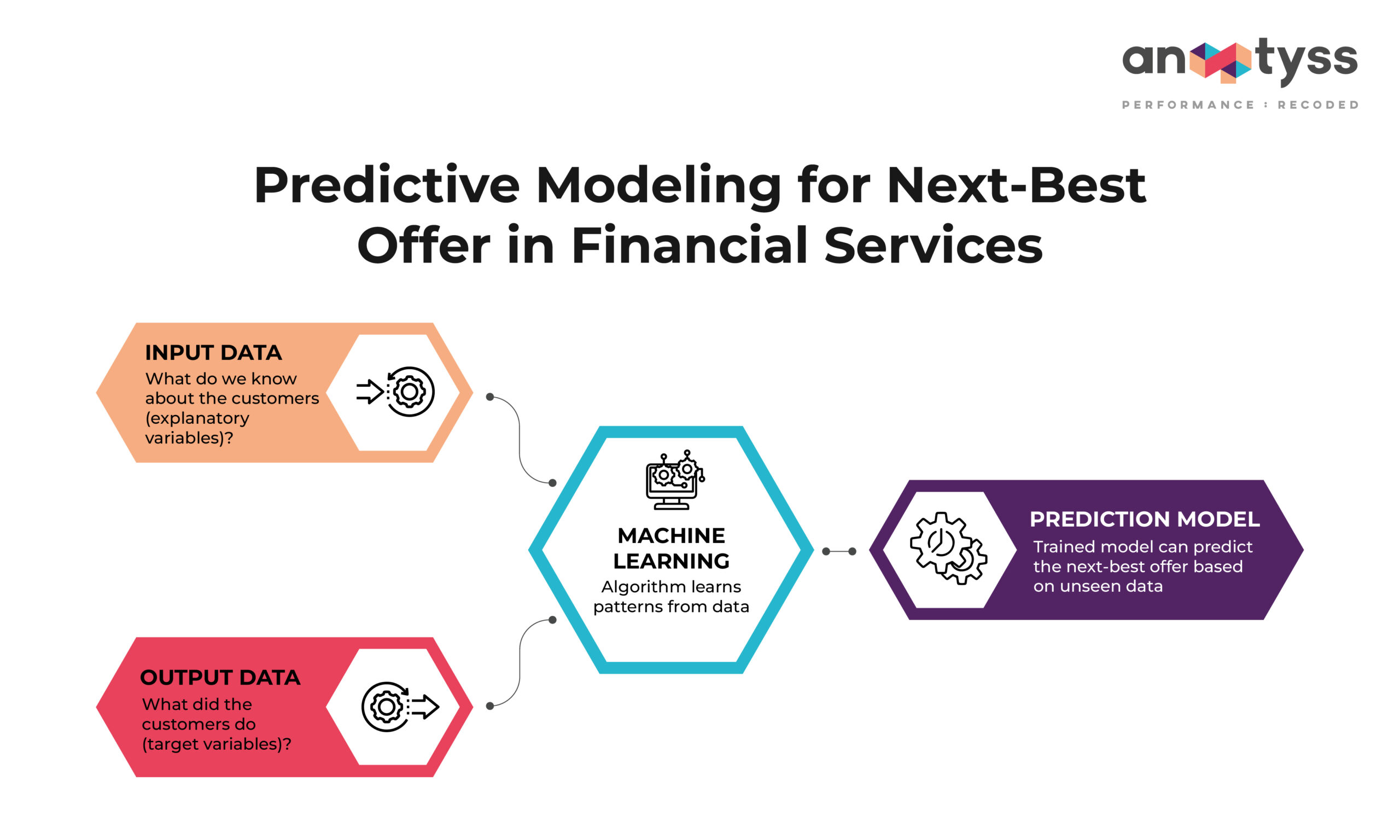

Input Data > Output data (known outcomes) > Machine Learning and AI > Prediction Model

Benefits of Next Best Offer Using Predictive Modeling

Following are some prominent benefits of using predictive modeling for the next best offer.

1. Increased Customer Engagement

Customers will most likely engage with offers relevant to their current needs and interests. Therefore, offering tailored products and services based on individual customer preferences and behavior is crucial to enhancing customer engagement.

With predictive analytics and NBO, banks and financial institutions can provide personalized offers and make customers feel valued and understood. This can boost engagement and lead to more interactions.

2. High Conversion Rates

With NBO, financial institutions can ensure that the right offer is presented to the right customer at the right time. This helps increase the conversion rate, reduces waste of time and resources, and boosts return on investment (ROI) for marketing campaigns.

McKinsey & Company found that personalization can deliver five to eight times the ROI on marketing spend and lift sales by 10% or more.

3. Boost Customer retention

Bain & Company research shows that increasing customer retention rates by 5% increases profits by 25% to 95%.

With predictive analytics and NBO, banks and financial institutions can consistently provide and deliver relevant and valuable offers to customers. It helps anticipate customer needs and enables banks or financial institutions to address them proactively, which reduces the likelihood of customers switching to competitors and builds a long-term relationship with the customer, fostering loyalty.

A report by Salesforce indicates that 84% of customers say being treated like a person, not a number, is very important to winning their business.

4. Enhance Cross-Selling and Up-Selling Opportunities

Predictive analytics also helps identify opportunities for cross-selling and upselling. According to a study by HubSpot, upselling can result in a 41% increase in average order value. By analyzing customer data and behavior, financial institutions can recommend complementary or higher-value products and services that customers are more likely to purchase.

In another survey by Zendesk, 74% of customers stated they are more likely to return to a business if they have had a positive cross-selling or upselling experience.

How to Implement the Next Best Offer with Predictive Modeling? Steps

Implementing the next best offer with predictive modeling requires some basic steps, as follows:

- Data Collection

Data collection and high-quality data are fundamental to developing accurate and reliable predictive models. The data should comprise details of customer demographics, transaction history, online behavior, and engagement metrics.

- Data Analysis

The data requires filtering and cleaning, which is followed by data analysis to identify patterns and trends. With advanced analytics techniques, such as machine learning and data mining, financial institutions can extract valuable insights from the data. This step also involves segmenting customers based on their behavior and preferences.

- Model Development

In this step, predictive models are developed using mathematical/statistical techniques and machine learning algorithms. The data is ingested to train the model to predict future customer behavior and identify the most relevant offers for each customer segment. Model development requires continuous refinement and updates to ensure accurate predictions over time.

- Offer Generation

The predictive model generates personalized offers for each customer based on data analysis and information feeds. These offers need to be relevant, timely, and aligned with the customers’ needs and interests. The goal is to generate offers that resonate with customers and encourage them to act.

- Delivery and Monitoring

This final step involves the delivery of personalized offers to customers through channels such as email, mobile apps, and websites. Monitoring the performance of these offers and continuously fetching feedback is crucial for improving the predictive model and next-best offer strategy.

Key metrics for measuring the performance of offers include engagement rate, conversion rate, and customer feedback.

Conclusion

Determining the next-best offers using predictive modeling and analytics can offer huge benefits to financial institutions through increased customer engagement, conversion rates, customer retention, and cross-selling and upselling.

With a strong NBO strategy and advanced analytics, banks and other financial institutions can deliver personalized offers that fuel customer satisfaction and business growth.

Want to learn more about predictive modeling? Reach us at info@anaptyss.com.