In this blog, we delve into the transformative role of automation and artificial intelligence in mortgage underwriting, illustrating how these technologies streamline operations and modernize loan origination. Traditional methods, plagued by delays and inefficiencies, are rapidly being superseded by AI-driven processes that enhance speed, accuracy, and customer satisfaction. We explore the benefits of AI in automating data analysis, reducing operational costs, and ensuring fair and consistent loan evaluations, ultimately fostering a more efficient and equitable lending environment.

Mortgage underwriting is one of the most critical processes in financial institutions to measure the level of risk associated with lending money to borrowers or prospective homebuyers.It’s a rigorous process of identifying and scrutinizing the borrowers’ identity, checking their credit history, and examining their financial health, cash flows, investments, liabilities, etc.

Underwriting a mortgage may take anywhere from a few days to weeks, depending on whether the application has some missing details, such as a signature in the application, lack of sufficient documents, or issues with verifying the identity or credit history of the borrower, etc. It can stretch to months or even longer for secured products such as home loans/mortgage loans, etc.

However, borrowers today want quick turnaround time and faster property security, which is possible only when financial institutions can swiftly process applications and respond quickly.

In this blog, we have discussed the role of automation and emerging technologies, such as AI, in reshaping mortgage underwriting and modernizing loan origination.

The Role of Automation and AI in Mortgage Underwriting

The traditional mortgage underwriting process is known for its complexity and slow turnaround for mortgage or loan approval. This is due to the involvement of extensive paperwork, manual verification, and a significant amount of resources and time requirements to process the information. It also creates backlogs in areas such as contact centres and back offices.

However, with automation and AI, financial institutions can overcome these challenges and transform the underwriting process to ensure efficiency, accuracy, and fairness.

As per ICE Mortgage Technology , 83% of mortgage lenders plan to increase their investment in AI and machine learning technologies in 2024, marking a significant shift from traditional processes.

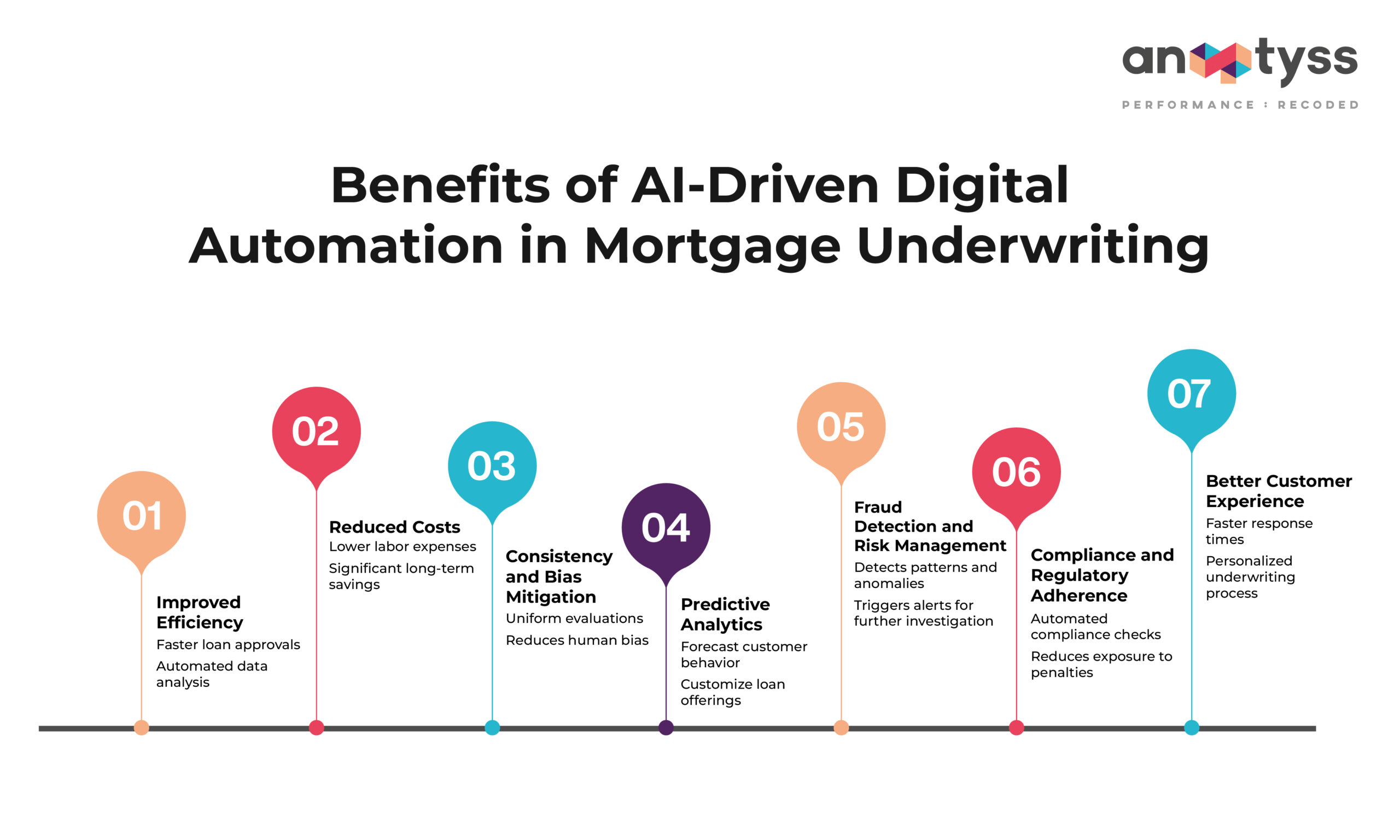

1. Improved Efficiency

Faster responses and loan approvals to borrowers improve customer experience and lender’s reputation. In recent times, the borrower’s journey has evolved drastically. Instead of waiting for weeks or months to get a loan approval, many of them are already pre-approved and the turnaround time for new approvals has also come down to a few days and even hours in some cases. By leveraging automated systems, financial institutions can quickly analyze and process data or information at a much faster speed and accuracy than humans.

“Financial institutions that adopted AI-powered underwriting systems reported a reduction by up to 30% -50% in processing and a significant increase in loan originations due to faster decision-making”

For instance, a borrower’s KYC document verification and creditworthiness can be automatically analyzed with automated underwriting that may take a few seconds or minutes to evaluate the borrower’s financial history and credit score, among other factors. It can help reduce the time to process, approve, or reject a loan application.

2. Reduced Costs

Although initial investments in automation and AI systems may appear substantial, the long-term advantages and cost savings are often significant. With intelligent automation, financial institutions can replace labor-intensive tasks and reduce the dependency on humans for repetitive tasks.

The McKinsey Global Institute (MGI) estimates that gen AI could add between $200-$340 billion in value annually across the global banking sector.

As a result, it lowers labor costs by 10-20%, minimizes the associated expenses, and enables financial institutions to utilize their internal resources more effectively and human expertise in complex scenarios requiring nuanced decision-making.

3. Consistency and Bias Mitigation

Consistency and precision are two crucial elements of automation. Another significant advantage of automation is that it voids human bias. With automated underwriting systems and processes, financial institutions can apply predefined rules and objective criteria to ensure fair and uniform evaluation of every loan application.

As a result, this adds more integrity to the lending process and builds trust among borrowers and lenders (investors).

4.Improved Fraud Detection and Risk Management

AI-powered automation and algorithms can process vast amounts of data to detect patterns and anomalies indicative of fraudulent activities that humans may indirectly overlook or miss. These systems can trigger alerts to underwriters or loan officers/advisors for further investigation, making the underwriting process more efficient.

In addition, intelligent automation can reduce the likelihood of manual errors and provide a more robust risk management framework.

This proactive approach enables financial institutions to minimize overlooking or miscalculations and make a more informed underwriting decision and cleaner documentation to reduce the risk of loan defaults and buybacks for lenders.

5. Predictive Analytics

AI-driven predictive modeling approach can use past data and statistical models to get valuable insights and predict future outcomes. It involves an assessment of the default rate and patterns related to repayment and also identifies how likely or whether the borrower will repay.

As a result, lenders can project future trends and take appropriate strategies for their mortgage portfolios leading to smart decisions related to lending and approval. Predictive analytics also helps financial institutions mitigate risks customize loan offerings to individual borrower profiles and deliver personalized solutions to enhance customer satisfaction.

6 . Adherence to Compliance and Regulatory Requirements

AI systems can automatically cross-check data for industry requirements and standards to ensure compliance. This also reduces exposure to penalties and complications and enables lenders to navigate the complex regulatory landscape easily.

7. Better Customer Experience

The faster a financial institution or lender can respond with a quote or rate, the more likely they will win a borrower. If it takes longer, there are chances that the customer may end up signing with another lender or financial institution.

In addition, AI-driven insights can further help personalize the underwriting process for the individual profiles of borrowers, making the lending process more personalized and responsive, thereby improving customer satisfaction and relationships between lenders and their borrowers.

Challenges and Considerations with Automation & AI in Mortgage Underwriting Process

There are several barriers when it comes to the traditional mortgage underwriting process. Below are three main challenges:

1. Data Privacy and Security Concerns

One primary concern is reliance on massive data and its potential impact onprivacy and security. The financial institution has to implement very stern measures that would be required to protect sensitive information and, at the same time, ensure compliance with requirements brought forth by regulators.

2. Lack of Transparency and Accountability

AI models, particularly the complex ones acting like “black boxes, create problems regarding transparency and accountability. The lenders will have to ensure their systems powered by AI are explainable (XAI) and decisions justified in a trustworthy way.

3. Human-AI Collaboration Challenge

While AI and automation bring numerous benefits, they also require new skills and competencies from the human workforce. These technologies cannot replace the critical role of humans in mortgage lending when it comes to a relationship between advisor and customer. Rapport, trust, and empathy are other positive factors associated with human interactions.

Elements such as data literacy, analytical thinking, and emotional intelligence are essential for effectively collaborating with AI systems and overseeing their operations.

Conclusion

By leveraging automation and AI, the mortgage industry can create a more efficient, fair, and secure lending environment which would benefit all stakeholders involved. Financial institutions across the globe are embracing digital transformation to automate loan journeys and keep up with the evolving markets’ and customers’ needs.

With more advancements in artificial intelligence (AI), such as generative AI which can automatically extract and organize data from unstructured documents, financial institutions can utilize their human expertise on more strategic tasks and achieve better outcomes with the same resources.

To learn more about the implementation of automation and AI-driven processes into your existing system and processes, reach us at: info@anaptyss.com