In this blog, we provide a comprehensive guide on the latest trends, benefits, challenges, and overview of global CBDCs for banks to navigate the future.

Central bank digital currencies (CBDCs) are digital versions of a country’s fiat currency issued and regulated by its central bank. It is estimated that 90% of the world’s central banks are engaged in some form of CBDC projects.

Unlike cryptocurrencies like Bitcoin, which are decentralized, CBDCs are centralized and backed by the full faith and credit of the issuing government.

CBDCs are poised to revolutionize the financial landscape, and banks must prepare for the changes.

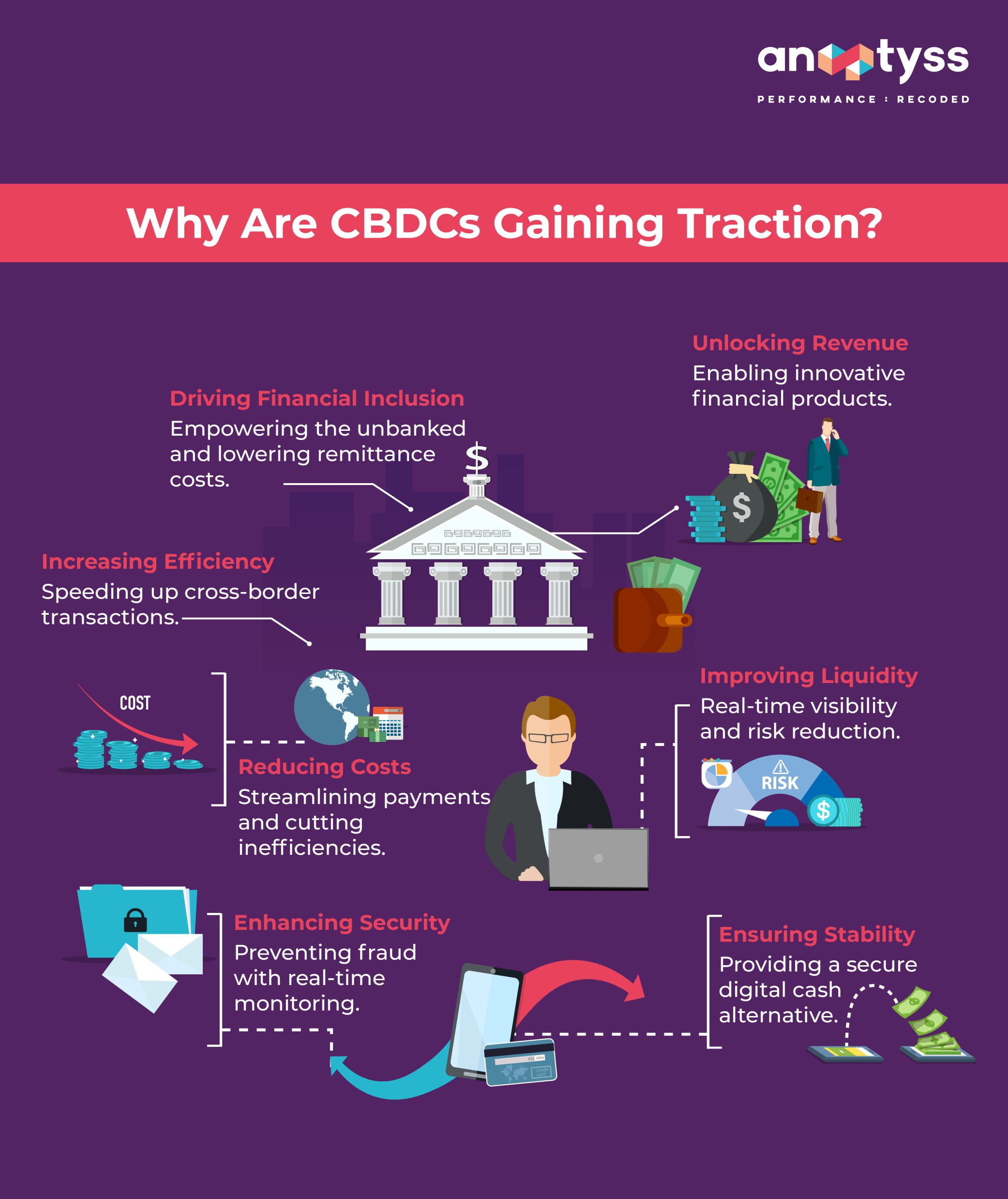

Why are CBDCs Gaining Traction: 7 Key benefits

The rise of digital payments, accelerated growth of cryptocurrencies, and the decline of cash usage are driving central banks worldwide to explore CBDCs.

A significant factor contributing to this trend is the increasing need for more efficient domestic and cross-border monetary interactions.

Additionally, a 2023 BIS survey found that a staggering 94% of central banks are actively researching CBDCs, with 134 countries representing 98% of the global GDP, exploring this new form of currency. To learn more about global trends shaping banking and financial services, refer to our blog on top trends in global banking and financial services industry.

This surge in interest is fueled by the seven key potential benefits of CBDCs, such as –

1. Enhanced Financial Inclusion

CBDCs can provide the underserved population with access to financial services, enabling financial inclusion and economic growth.

For example, migrants often face high transaction fees when sending money back home, averaging 6.25%, according to the World Bank. CBDCs could significantly reduce these costs by removing intermediaries and making remittances more affordable and efficient.

2. Reduced Transaction Costs

CBDCs have the potential to streamline payment systems, cutting down the transaction costs associated with cash handling, manual reconciliation, and regulatory compliance.

By digitizing currency, central banks can eliminate inefficiencies in existing systems and human errors, which could further lower operational costs and ensure more cost-effective transactions.

3. Improved Payment Security

CBDCs can enhance payment security by incorporating advanced digital identity verification and real-time transaction monitoring. These measures can further help in:

- Reducing fraud and other financial crimes.

- Making digital transactions much safer.

- Building trust among users.

4. Increased Efficiency

CBDCs can speed up transaction processing times, especially when it comes to navigating cross-border payments and AML regulatory challenges.

The Bank for International Settlements (BIS) suggests that CBDCs can expedite cross-border transactions by simplifying the settlement process and reducing reliance on correspondent banking networks.

5. New Revenue Streams

CBDCs provide banks with opportunities to develop and offer innovative financial products and services, creating new revenue channels.

For example, banks could leverage programmable money enabled by CBDCs to offer features like automated payments, escrow services, or conditional transactions tailored to customer needs. These new capabilities position banks as leaders in digital financial innovation.

6. Enhanced Liquidity Management

CBDCs can provide banks with real-time visibility into their liquidity positions, improving liquidity management and reducing risk. The continuous monitoring capabilities of CBDC infrastructure enable banks to identify and address potential liquidity issues proactively.

7. Increased Financial Stability

CBDCs provide a secure and stable digital alternative to cash, helping to maintain financial stability. By integrating CBDCs into the monetary system, banks can support a seamless transition to digital currency while ensuring the security and trust to maintain economic stability.

5 Key Challenges Traditional Banks Face in Adopting CBDCs

While CBDCs offer significant potential, banks also face several challenges:

1. Impact on Bank Profitability and Liquidity

CBDCs could potentially reduce the role of traditional banks as intermediaries. By allowing people to hold money directly with central banks, CBDCs may reduce the reliance on traditional or commercial banks for deposits, affecting their profitability.

This shift could reduce demand for traditional banking products like loans and savings accounts, which could further raise liquidity risks for traditional banks. And with fewer deposits, traditional banks may face challenges in maintaining their lending capacity and operational efficiency.

2. Cybersecurity Risks

Despite improved payment security, CBDCs remain vulnerable to cybersecurity risks at a systemic level. Their digital nature makes them potential targets for sophisticated cyberattacks, unauthorized access to CBDC systems, and risks, such as counterfeiting and double-spending.

Additionally, threats such as malware, ransomware, and large-scale Distributed Denial of Service (DDoS) attacks could disrupt CBDC transactions and impact financial stability.

However, implementing robust security measures and maintaining the necessary infrastructure can be particularly challenging for banks. Smaller and mid-sized banks may struggle with the high costs, technical complexity, and need for specialized expertise required to safeguard CBDC systems against evolving cyber threats.

To understand how cybersecurity regulations and standards can safeguard financial services, refer to our blog on cybersecurity laws, regulations, and standards for the financial services industry.

3. Balancing Privacy and Compliance

CBDC requires a careful balance between protecting user privacy and adhering to strict regulatory requirements for anti-money laundering (AML) and know-your-customer (KYC) compliance. For instance, customers may hesitate to adopt CBDCs if they perceive a lack of privacy or government surveillance.

Protection and sanitization of highly confidential financial data with transparency is another crucial aspect.

4. Technological InfrastructureRequirements

Banks will need to upgrade their technological infrastructure to support CBDC integration and interoperability with existing systems like cross-border and real-time digital payment systems. This includes:

- Distributed Ledger technology (DLT) for secure and efficient transaction recording.

- Digital wallets to enable customer access and usability.

- API integration for interoperability with existing financial tools and systems.

- Geo-fencing

- Offline functionality to ensure usability in areas with limited internet connectivity.

However, handling large transaction volumes without compromising efficiency or reliability is a significant challenge for banks when it comes to CBDC adoption.

To explore how microservices address technological challenges, refer to our blog implementing microservices in financial systems: challenges and their solutions.

5. Regulatory Uncertainty

The regulatory landscape for CBDCs is still evolving. Thus, there’s uncertainty for banks in terms of compliance, reporting, and operational requirements. Additionally, different jurisdictions may have or adopt different rules for CBDCs that could complicate cross-border transactions and international banking operations. Some of the key regulatory concerns include:

- AML/CFT compliance

- Data privacy

- KYC requirements

- Consumer protection

Therefore, banks will need to be agile about adapting to new regulatory changes and compliance standards that could emerge as CBDC evolves.

For insights into building efficient compliance systems, read our blog on build a robust transaction monitoring system for AML compliance. You can also read how to navigate cross-border compliance challenges to navigate compliance complexities.

Global Central Bank Digital Currencies (CBDCs) Overview

| Country | CBDC Name | Status | Key Features |

| The Bahamas | Sand Dollar | Launched (2020) | Financial inclusion, retail payments |

| Nigeria | eNaira | Launched (2022) | Financial inclusion, cross-border payments |

| China | e-CNY | Pilot program | Retail payments, cross-border applications |

| Sweden | e-krona | Pilot program | Offline functionality, integration with systems |

| India | Digital Rupee | Pilot program (2022) | Wholesale and retail transactions |

| Eurozone (ECB) | Digital Euro | Development phase | Financial stability, cross-border payments |

| Jamaica | JAM-DEX | Launched (2022) | Financial inclusion, digital payments |

| Russia | Digital Ruble | Pilot program | Cross-border payments, domestic transaction efficiency |

| Brazil | Drex | Pilot program | Financial inclusion, retail and wholesale payments |

| Singapore | Project Orchid | Research phase | Programmable money, smart contracts |

| South Korea | Digital Won | Pilot program | Offline functionality, digital wallets integration |

| Canada | Digital Canadian Dollar | Research phase | Cross-border interoperability, financial inclusion |

| Japan | Digital Yen | Pilot program | Retail payments, security, and privacy compliance |

| Australia | eAUD (pilot name) | Research phase | Programmable payments, blockchain integration |

| United States | FedNow (Not CBDC)** | Active (2023) | Real-time payments, CBDC research ongoing |

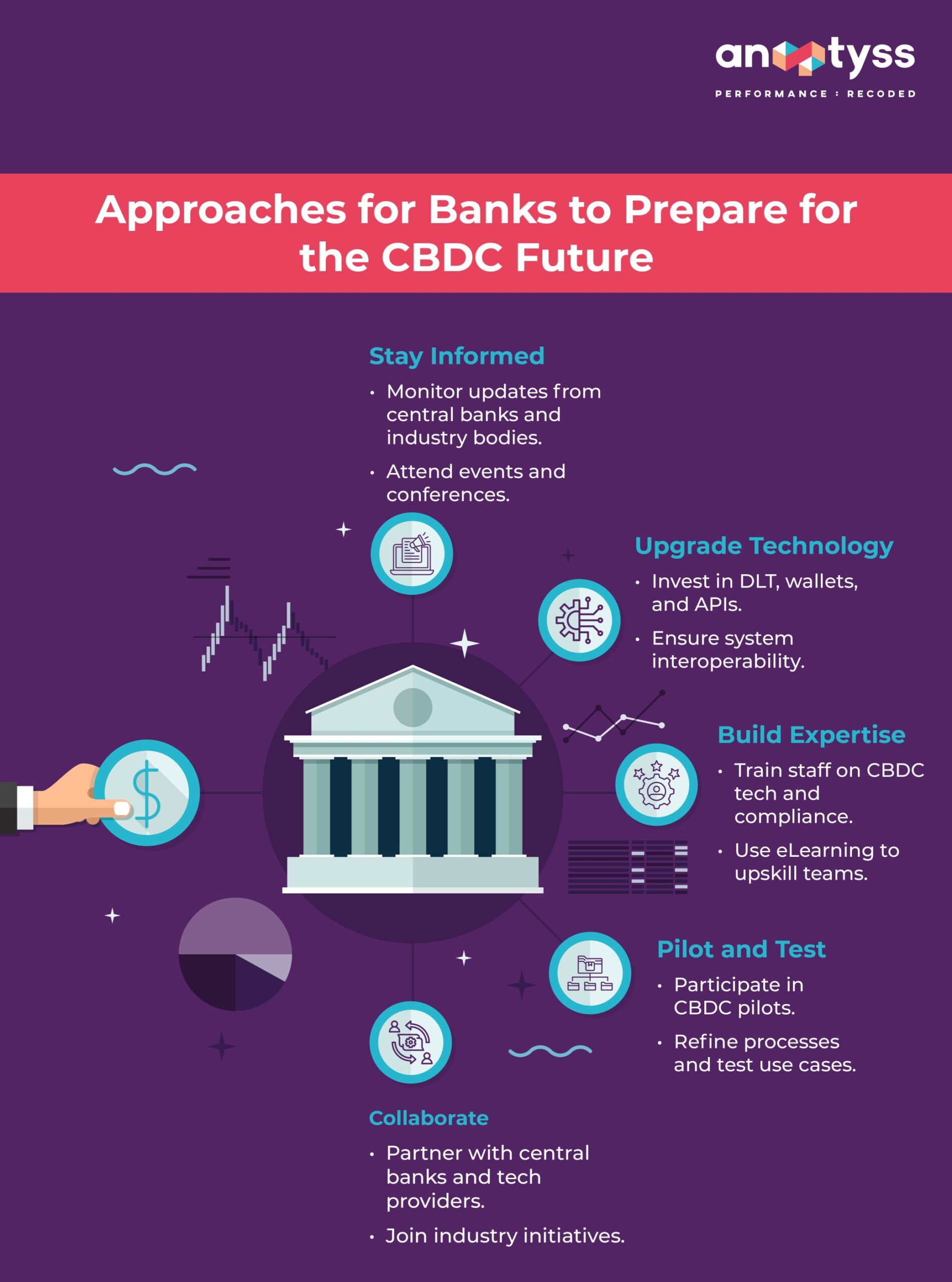

Approaches for Banks to Prepare for the CBDC Future

Banks can take proactive steps to prepare for the CBDC future.

1. Stay Informed

Keep abreast of the latest CBDC developments, research, and regulatory guidance. Actively monitor publications and announcements from:

- Central banks

- International organizations (e.g., IMF, BIS) and research institutions

- Participate in industry events and conferences to stay informed about the latest trends and best practices.

2. Invest in Technology

Upgrade technological infrastructure to support CBDC integration and interoperability. This includes investing in robust and scalable DLT platforms, secure digital wallets, and APIs for seamless integration with existing banking systems.

3. Develop Expertise

Build internal expertise on CBDC technology, regulation, and operational considerations. Train staff on CBDC functionalities, security protocols, and compliance requirements. Foster a culture of continuous learning and knowledge sharing to stay ahead of the curve.

Leverage digital learning or eLearning platforms to rapidly skill and upskill workforce.

4. Collaborate

Engage with central banks, technology providers, and other stakeholders to shape the CBDC ecosystem. Participate in pilot programs and contribute to the development of industry standards and best practices.

5. Pilot Programs

Participate in CBDC pilot programs to gain practical experience and refine operational processes. Actively test and evaluate different CBDC use cases and technologies to identify optimal solutions for your bank and customers.

Conclusion

CBDCs are ready to reshape the financial landscape, presenting opportunities and posing challenges to traditional banks. It is upon the banks to understand the potential benefits, challenges, and key considerations to proactively prepare for the CBDC future.

This guide has provided an overview of CBDCs, their implications for banks, and the steps banks can take to navigate this new era briefly.

At Anaptyss, we specialize in helping financial institutions stay ahead in the ever-evolving digital landscape. With our 8+ decades of combined expertise in compliance, risk management, and digital transformation, we empower banks to embrace innovations like CBDCs seamlessly.

For more information or to explore how we can help your organization, feel free to contact us at info@anaptyss.com.