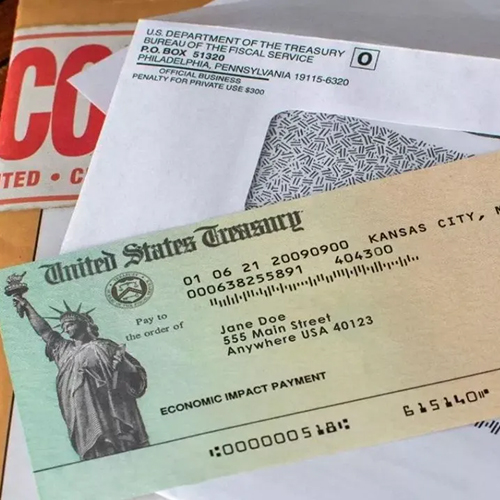

FinCEN's latest alert highlights a significant rise in theft-related check fraud targeting U.S. Mail. Criminals are stealing and fraudulently negotiating various types of checks, including personal and government-related checks. Financial institutions are urged to identify red flags, report suspicious activities, and take preventive measures to combat this growing threat.

The Financial Crimes Enforcement Network (FinCEN) has issued a new nationwide alert—FIN-2023-Alert003—to banks and financial institutions on theft-related check fraud schemes targeting the U.S. Mail.

Check fraud is the largest source of illicit proceeds in the United States. Frauds in general, including check fraud, are one of the largest sources of money laundering in the United States and a threat to the integrity of the US financial system. Fraud is also one of the AML/CFT National Priorities.

This blog shares key takeaways and red flags, providing a quick summary of the recent FinCEN alert on check fraud.

FinCEN Alert on Surge in Theft-Related Check Fraud

While the use of checks in the United States is declining, criminals have been increasingly targeting the United States Mail and the USPIS mail carriers in the last three years (since 2020—the COVID-19 pandemic) to commit check fraud.

Criminals steal all kinds of checks, including personal checks, tax refund checks, business checks, and other checks related to government assistance programs, such as unemployment benefits and Social Security payments.

After the initial theft and fraudulent negotiation of the stolen checks, criminals continue to exploit the victims’ personally identifiable information (PII) found in the stolen U.S. mail for future fraud schemes, such as credit account fraud or credit card fraud.

During March 2020 – February 2021, USPIS received 299,020 mail theft complaints—a rise of 161% from the same previous duration. Financial institutions also files more than 350,000 SARs to FinCEN in 2020 to report suspicious check fraud. Again, a 23% rise when compared to 2020. In 2022, the number of SARs filed related to check fraud reached 680,000+.

Red Flags Indicators to Mail Theft-Related Check Fraud

FinCEN in coordination with the United States Postal Inspection Service (USPIS) issued the alert to ensure financial institutions appropriately identify and report suspected check fraud schemes while filing the SARs linked to the U.S. mail theft.

The FinCEN Acting Director Himamauli Das said,

“FinCEN is proud to partner with the United States Postal Inspection Service in producing this important and timely alert on mail theft-related check fraud designed to assist financial institutions in reversing this disturbing trend,”

“Their vigilance and timely reporting will help law enforcement identify illicit actors who steal mail to defraud innocent American taxpayers and businesses.”

It also identified red flags that financial institutions need to look for to detect, prevent and report suspicious activities associated with the recent surge in mail theft-related check fraud.

- Unusual large withdrawals from a customer’s account via check to a new payee

- The customer claims that a check or checks were stolen from the mail and deposited into an unknown account

- Customer complains that a check they mailed was never received by the intended recipient

- Checks used to withdraw money from a customer’s account seem to be made of a noticeably different check stock than checks used for known, legitimate transactions and by the issuing bank

- An existing customer who has never deposited checks before has recently made several check deposits, withdrawals, or fund transfers

- Unusual, abrupt, abnormal check deposits that frequently occur electronically are followed by quick money transfers or withdrawals

- When suspect checks are examined, they reveal faded handwriting beneath darker handwriting, giving the impression that the original handwriting has been overwritten

- Suspicious accounts may show signs of other suspicious activity, such as pandemic-related fraud.

- A new customer opens an account that appears to be used only for check deposits, followed by frequent withdrawals and transfers of funds

- Anyone who isn’t a customer is attempting to cash a large check or several large checks in person and provides an explanation that is suspicious or potentially indicative of money mule activity when questioned or interrogated.

While observing the above red flags for potential mail theft-related check fraud, financial institutions also need to consider surrounding facts, such as customers’ profiles, historical financial activities, and other circumstances, including their business practices and any customer red flags. Financial institutions are also encouraged to perform additional due diligence and enhanced due diligence where appropriate in accordance with their risk-based approach to BSA compliance.

Key Imperatives to Meeting AML/CFT Compliance

Filing SARs related to suspicious activities to deter check fraud and other financial crimes is one of FinCEN’s key priorities to counter money laundering and terrorism financing activities.

In addition to SAR filing, financial institutions must inform their customers to contact the USPIS at 1-877-876-2455 or https://www.uspis.gov/report to report an incident of potential mail theft-related check fraud.

Anaptyss as a strategic partner helps banks and other financial institutions with domain-centric consulting, intelligent digital solutions, and hands-on execution ability to improve their AML/CFT compliance capabilities and meet various regulatory obligations.

Read the complete FinCEN alert on the surge in mail check fraud here.

Interested in more specific guidance for AML/CFT compliance? Write to us: info@anaptyss.com.