The rise of Agentic AI—autonomous systems capable of making decisions, learning from interactions, and acting independently—is reshaping financial services and banking at an unprecedented pace. This technology is not just a buzzword anymore but a transformative force enabling banks to drive efficiency, security, and customer-centric innovation.

According to a 2023 report by the Boston Consulting Group), autonomous AI systems could unlock US$300 billion in annual revenue opportunities for banks by 2030.

This blog explores how Agentic AI enables financial institutions to anticipate, assess, and mitigate risks in real time.

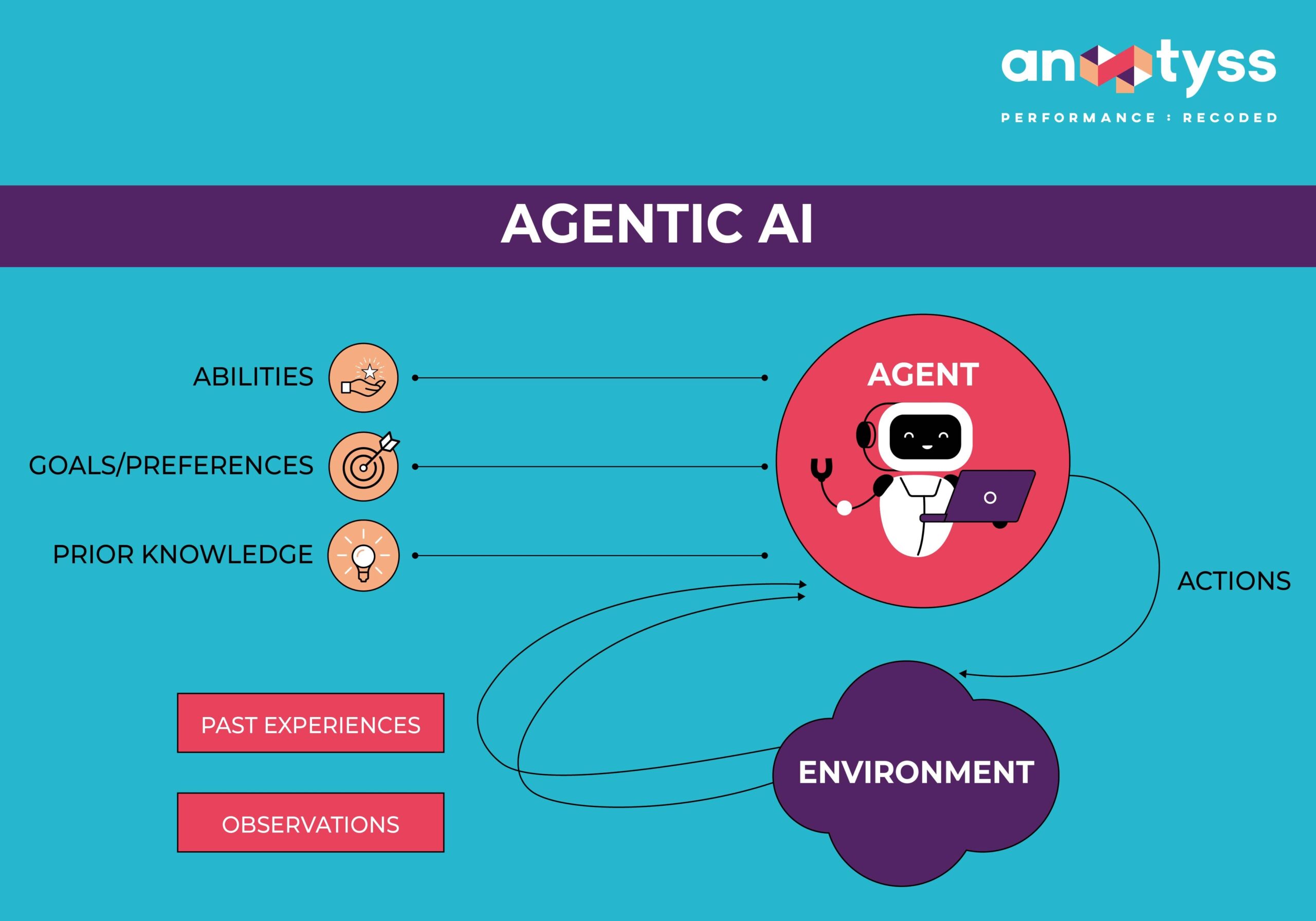

What is Agentic AI?

Agentic AI refers to systems that operate with a degree of autonomy. They use advanced machine learning (ML), natural language processing (NLP), and reinforcement learning to make context-aware decisions without human intervention. They can also do the following:

- Adapt to dynamic environments (e.g., market fluctuations, customer behavior).

- Self-improve through continuous data analysis.

Unlike traditional rule-based AI which relies on predetermined rules or supervised machine learning models, Agentic AI acts as a “proactive” agent. It can sense its environment, make decisions, and act without constant human intervention to solve complex problems in real-time.

For instance, JPMorgan Chase’s AI-powered cash flow management model can cut manual work by almost 90%. In financial risk management, Agentic AI can help human experts identify and mitigate risks before they materialize.

By leveraging the self-learning and adaptive capabilities of Agentic AI, financial institutions can address a broad spectrum of enterprise and financial risks proactively.

How is Agentic AI Helping Banks and Financial Institutions?

The following are some key domains where Agentic AI is making a significant impact.

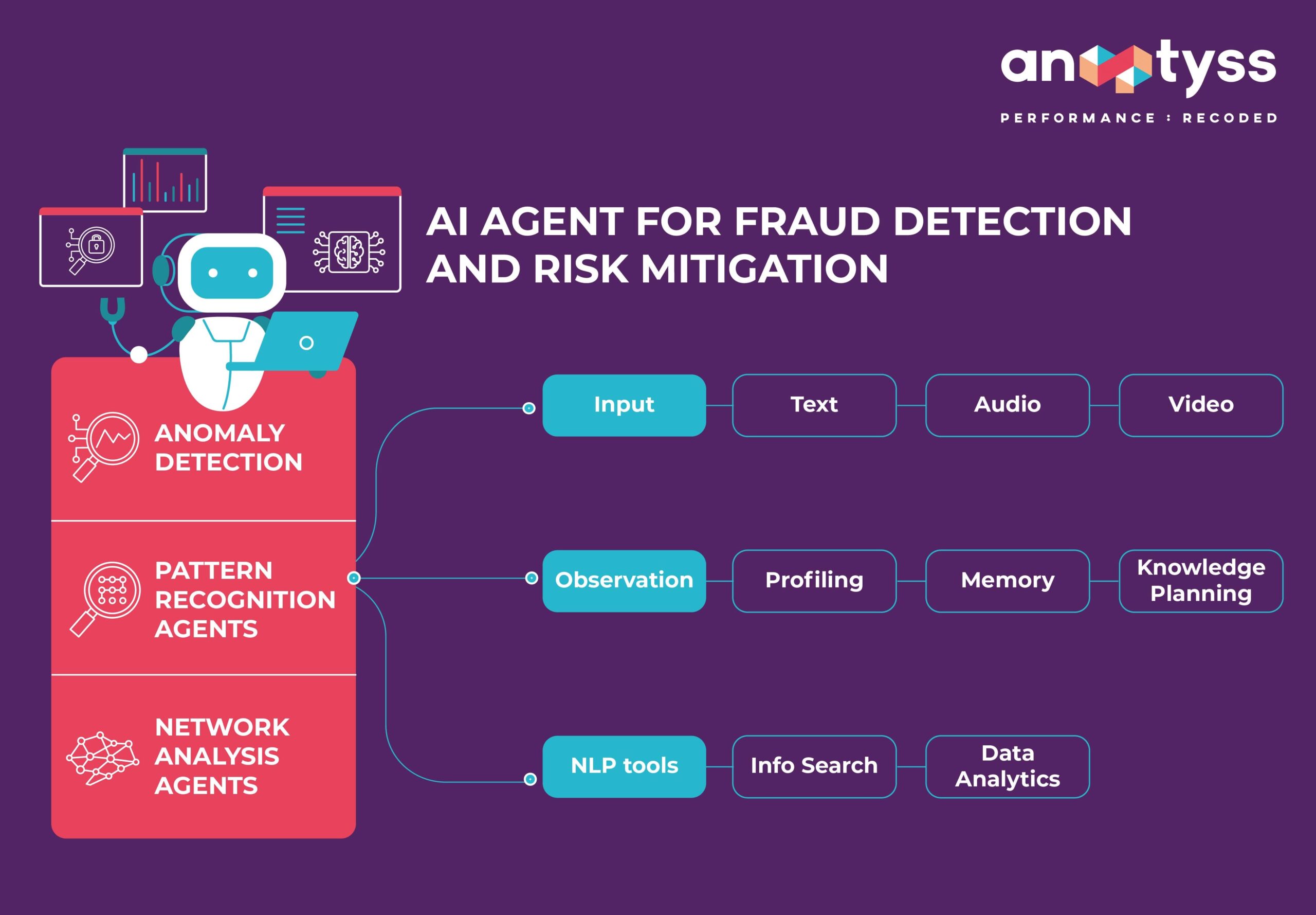

1. Fraud Detection and Risk Mitigation

In 2023, the Federal Trade Commission (FTC) reported that the United States lost $10 billion to fraud, a 14% increase from 2022. Agentic AI can help banks combat fraud risks by:

- Analyzing transaction patterns within milliseconds in real-time)to flag anomalies.

- Learning from historical fraud cases to predict new attack vectors.

2. Customer Service – Not Just Chatbot

With Agentic AI, banks and financial institutions can transform their customer service leaving behind the era of generic, robotic responses. For instance, Erica (Bank of America) and Eno (Capital One) are some examples of advanced AI agents that have redefined customer interactions through personalized, intelligent, and proactive support.

- Predict needs Erica – the virtual finance assistant – uses predictive analytics and cognitive messaging to provide financial advice or identify savings opportunities. For example, it may nudge users about overdraft risks before they overspend.

- Read emotions Wells Fargo’s chatbot employs sentiment analysis in conversations with customers. It can identify frustration from the tone or wording in a chat and adjust its tone, offer a customized reassurance message, or escalate the issue to a human representative immediately if it senses negative sentiment.

It is estimated that between 75% and 90% of interactions will soon be handled using agentic AI chatbots, freeing the human staff to tackle more complex issues.

3. Credit Inclusivity

Traditional credit scoring approaches might exclude borrower segments such as gig workers, immigrants, and young adults who lack a credit history. Agentic AI can help flip the script in the following ways:

- Alternative Data

Upstart leverages Agentic AI to analyze alternative data such as college majors, job history, and even social media activity on platforms, such as LinkedIn to approve 27% more loans since 2017—with lower default rates. - Inclusive Mortgages for Gig Workers

In the United States, traditional mortgage underwriting excludes gig economy workers with irregular income streams. To address this, Freddie Mac has enhanced its Loan Product Advisor® (LPA℠) with the Asset and Income Modeler (AIM) for self-employed borrowers. This integration utilizes advanced technology to analyze income trends over time, considering various data sources such as bank deposits and information from gig platforms.

Through advanced LPA capabilities, Freddie Mac comprehensively assesses a gig worker’s financial stability, expanding homeownership opportunities for individuals who might have been overlooked by conventional underwriting methods.

4. Compliance Risk Management

Regulatory compliance costs banks over US$270 billion annually, making it one of the biggest operational overheads. Agentic AI can streamline compliance processes by:

- Automating the KYC/AML processes

For example, Deutsche Bank leverages AI to scan several thousands of documents and other sources in depth, reducing the handling time by up to 50% and saving 10s of 1000s of hours annually.

- Real-time financial crime detection and reporting

For instance, Symphony AyasdiAI’s Sensa™ platform employs advanced AI and machine learning to detect complex, hidden money laundering activities. In beta testing, Sensa™ identified new alerts, with over 90% deemed significant, and accelerated detection times by up to 12 months compared to legacy systems, helping banks avoid billion-dollar fines.

Challenges in Implementing Agentic AI

Here are some of the major challenges banks and financial institutions might run into while implementing or deploying AI agents.

1. Data Privacy and Security

Ensuring that AI systems comply with data protection regulations, such as CCPA and GDPR, is critical. Banks and financial institutions handle a vast amount of sensitive customer data and transaction data that needs to be managed with utmost care to prevent breaches and misuse. A single data breach can lead to severe repercussions, ranging from regulatory penalties and reputational damage to litigation and market loss.

2. Transparency and Explainability

Agentic AI systems often function as “black boxes,” making it difficult for stakeholders to understand their decision-making processes. This lack of explainability and transparency can hinder regulatory approval and lead to a loss of trust among stakeholders. For instance, a bank using AI for credit scoring may face scrutiny when applicants are denied without clear explanations. This could also lead to regulatory intervention.

3. Ethical Considerations

AI-driven risk management systems must avoid biases in decision-making, which could affect specific customer groups. It is important to ensure fairness and ethical use of AI, which is a growing concern among banks and regulators. To overcome this, banks need to continuously monitor and audit their AI models to prevent biased outcomes. However, this process can be time-consuming, resource-intensive, and require technical expertise.

Conclusion

The rise of Agentic AI marks a turning point in the financial industry’s approach to risk management. By transitioning from reactive to proactive strategies, financial institutions can navigate an increasingly volatile landscape with greater agility, precision, and confidence. While challenges like data security, transparency, bias mitigation, and ethical considerations remain, the benefits of adopting Agentic AI far outweigh the risks. Anaptyss can help your institution overcome these hurdles and unlock the full potential of Agentic AI. From strategy to deployment and ongoing optimization, we provide the expertise and tools to drive measurable results.

Reach us at info@anaptyss.com to get started.