This blog outlines essential practices for financial institutions to combat money laundering and ensure AML compliance. It includes a checklist of key actions such as appointing a CCO/MLRO, maintaining updated policies, providing staff training, and conducting regular reviews. Emphasizing the importance of sanctions and PEP screening, CDD, and timely submission of SARS, the blog highlights the risks of non-compliance. The Digital Knowledge Operations™ (DKO) framework by Anaptyss provides a comprehensive approach to meet AML obligations effectively.

Money Laundering is a persistent problem globally. As per UNODC, 2-5% of global GDP ($800 billion – $2 trillion) is the estimated amount of money laundered in a year.

The vast umbrella of Anti-Money Laundering (AML) Compliance obligates financial institutions to deter any potential money laundering activity, primarily through proactive tracking and reporting of suspicious transactions to authorities. However, this entails extensive transaction monitoring and due diligence, which has challenges such as volume of transactions, sanctioned entities, false positives, domain expertise, etc.

This blog shares a checklist of action items and best practices for financial crime teams that can help them as a ready reckoner to follow through with the key imperatives for complying with AML regulations.

Before the checklist, here’s a list of red flags that typically indicate a money laundering activity.

Potential Red Flags for Money Laundering

- Unusually high amount of transactions

- Large cash transactions

- Immediate withdrawal of funds from the account

- Inconsistent transfers without any logical explanation

- Discrepancies in the identity verification/KYC process

- Small and frequent transfers to different accounts

- Conversion to virtual assets or vice versa

- Transactions from unregistered geographies

- Multiple accounts under the same client

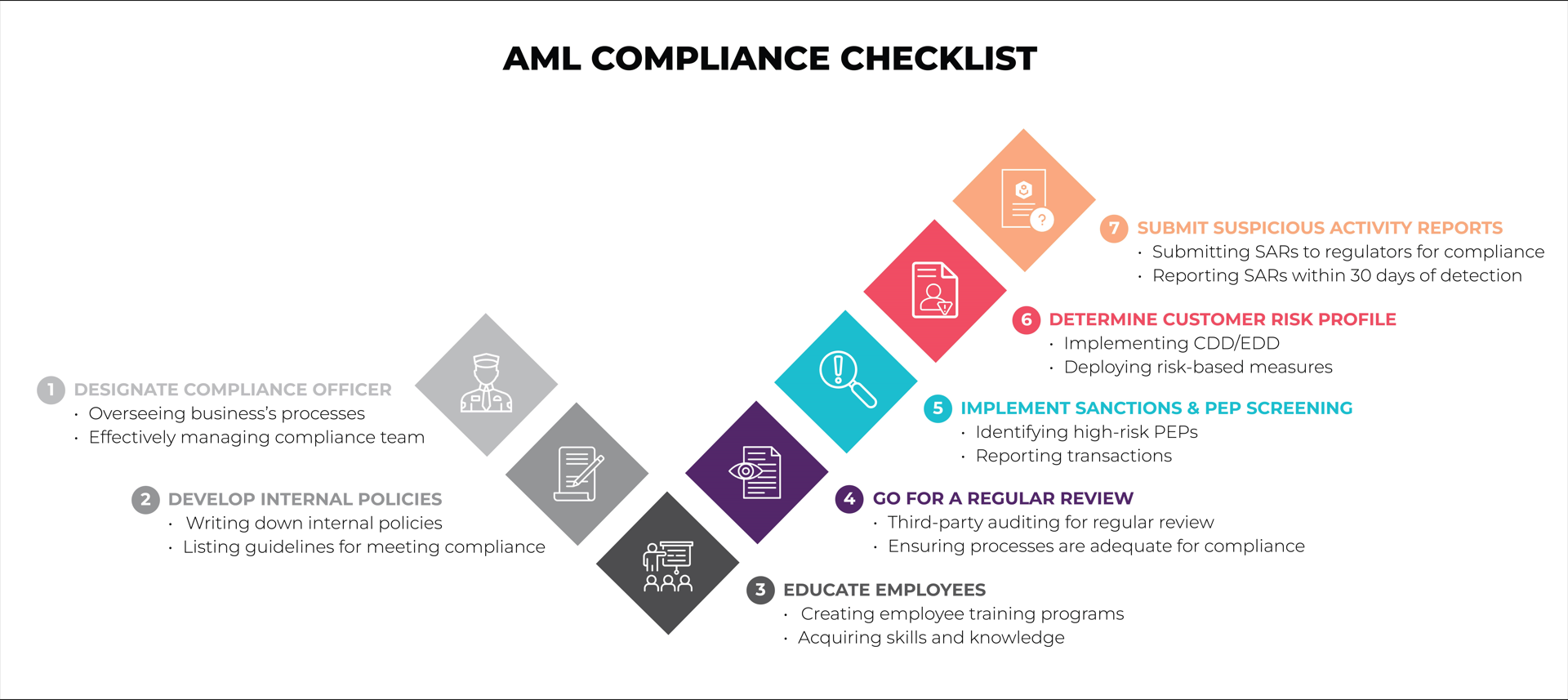

AML Compliance Checklist

We have broadly covered the most relevant anti-money laundering legislation and regulatory checklists as a reminder for you. Here’s what is expected from the financial institutions:

1. Assign a dedicated CCO/MLRO

You’ll need someone at the top of the hierarchy to ensure that the policies are being administered consistently, the processes are aligned with the program, customer files are up to date, and training is efficient and on time.

Designate a Chief Compliance Officer (CCO) or a Money Laundering Reporting Officer (MLRO) to develop, implement and administer all aspects of the applicable program and act as a liaison for the financial authorities.

2. Get the written policies under check

Construct written internal policies to be followed by all the members to limit and control the risks. The policies need to specify the guidelines for meeting AML regulations and compliance imperatives, KYC and identification needs, monitoring and reporting suspicious activities, etc.

3. Provide proper training to members

Provide training to employees, agents, and brokers concerning their responsibilities in maintaining compliance. Anyone who deals with your customers and transactions needs to be trained about your jurisdiction-specific AML legal requirements, common techniques used by money launderers, policies to abide by during onboarding, and how to report suspicious activities.

4. Go for a regular review

Anti-money laundering compliance is an ongoing activity. Your programs need to be updated from time to time with the relevant regulations. Schedule an independent third-party review for all the policies and procedures, officer qualifications, and training materials to ensure that the records, reports, and processes are on point.

5. Implement sanctions & PEP screening

Politically Exposed Persons (PEPs) have more opportunities to earn illegal income, hence they are high-risk customers. It’s important for banks to explicitly identify PEPs and report their transactions according to the BSA regulation. Banks should be careful to not allow any individuals, companies, or countries that are named on international sanctions lists to hold an account with them. A proper sanctions screening process should also be performed to prevent, detect, and report suspicious money laundering transactions.

6. Determine your customer’s risk profile via CDD

Customer Due Diligence (CDD) is an AML component that requires you to identify the nature and purpose of customer relationships and report suspicious transactions while conducting ongoing monitoring of the beneficial owner(s) of legal entity customers. CDD combined with Enhanced Due Diligence (EDD) helps in identifying:

- A customer’s personal information (their name, address, and date of birth)

- Beneficial ownership of a company

- The nature of the business in which the customer is involved

Deploy risk-based measures such as sharing or obtaining customer information across business lines, separate legal entities within an enterprise, and affiliated support units. You can refer to the FFIEC BSA/AML Manual to learn more about assessing Anti-money laundering compliance with BSA/AML requirements.

7. Submit Suspicious Activity Reports (SARS)

As a part of the BSA compliance obligation, financial organizations must submit SARS no later than 30 days after the initial detection of money laundering. If no suspect is identified on the date of detection of the incident requiring the filing, the organization may delay filing the report for an additional 30 calendar days to identify a suspect.

Violating AML Regulations – Key Implications

Not complying with anti-money laundering regulations can lead to vast implications, including monetary loss, legal action, reputational risks, etc., as follows:

- Loss of licensing

- Insurance revocation

- Cease and desist order

- Formal written agreement

- Penalties of up to US $500,000 or twice the transaction amount

- Monetary loss from the asset forfeiture actions, fraud, or charge off

- Loss of company value

- Substantial legal fees

- Risk to reputation

Consulting-Led Approach to Meeting AML Compliance

Financial institutions need to explore a multi-pronged approach based on data-driven decision-making, people readiness, and technology for a long-term strategy to meet anti-money laundering compliance. Starting with a carefully drafted and audited internal policy framework, the AML compliance strategy needs to pivot on human expertise and intelligent digital tools to ensure effective tracking and reporting of transactions.

The Digital Knowledge Operations (DKO)™ framework can offer a viable solution as it combines these critical aspects in a customized manner to help financial institutions fulfill AML obligations.

Anaptyss had implemented the DKO™ framework to offer a consultative BSA/AML-focused risk mitigation program for a US-based community bank.

Interested in knowing how the DKO-based solution approach can help your financial institution address AML issues and attain compliance? Please reach out to us at: info@anaptyss.com.