In this blog, we provide a comprehensive guide to anti-money laundering (AML) for banks and financial institutions, detailing the mechanisms of money laundering, the need for robust AML compliance, and key obligations such as KYC, transaction monitoring, SAR, and CTR. Learn how to set up an effective AML compliance program, including risk assessment, policy development, employee training, and independent audits. Discover how Anaptyss's domain expertise and digital solutions can enhance your AML efforts and safeguard against financial crimes.

Anti-money laundering or AML in banking and finance refers to the legal obligations, set of rules, procedures, and regulations to prevent and counter money laundering.

Financial institutions need to implement dedicated frameworks and systems to monitor and report fraudulent activities to safeguard themselves from compliance risks and fulfill regulatory obligations.

For instance, banks need to implement an AML transaction monitoring system to detect and prevent money laundering activities to ensure that illicit money does not exploit their system.

This blog provides a guide for anti-money laundering to help banks and other financial institutions in the purview of BSA/AML/CFT regulations.

How Does Money Laundering Happen? Key Mechanism

Money laundering involves a slew of deceptive activities to legitimize illegal money generated through illicit activities such as drug trafficking, smuggling, shell companies, etc.

Its goal is to hide the sources of illegal money and “launder” it into the formal financial system as legitimate money. Money laundering entails three steps or stages:

1. Placement

In this stage, the illegal or dirty money is placed or injected into legal financial systems through activities such as smurfing, invoice fraud, offshore accounts, etc.

2. Layering

The layering stage layers or separates the funds from the source and conceals the money trail.

3. Integration

In the final integration stage, the laundered funds are invested in real estate, luxury goods, stocks, and other avenues/instruments.

After the money is laundered, it becomes difficult for banks and financial institutions to differentiate the money from legitimate sources and apprehend the criminals.

Need for AML Compliance in the Banking Industry

Over the past two decades, AML legislation has become increasingly stringent for banks and financial service providers. In tandem, the digitized landscape and alternate finance give rise to novel money laundering scenarios, resulting in stronger regulatory measures to counter money laundering. Amid this scenario, banks need to step up their AML compliance efforts for various reasons as follows:

1. Increasing Regulatory Action

Regulatory enforcement concerning AML violations has been on the rise over the past decade. According to McKinsey, regulatory actions against banks have been almost steadily growing. In 2009, there were 5 actions, which grew up to 21 actions in 2018.

Further, the amount of money involved in each action has also increased. Regulatory agencies in the United States also have the power to impose huge fines and penalties if an action is successful.

2. Evolving Threat

Criminals and their money laundering gambits have become more sophisticated over time, posing a threat to the formal banking system. The rise of lone-wolf terrorists, cyber-enabled criminals, and illicit e-commerce portals are some of the new threats.

3. Reputational Risks

Money laundering incidents, once discovered, are widely reported, causing great reputational harm to the bank. Since the brand value of a bank is of paramount importance, the need to safeguard against money laundering risks is even greater.

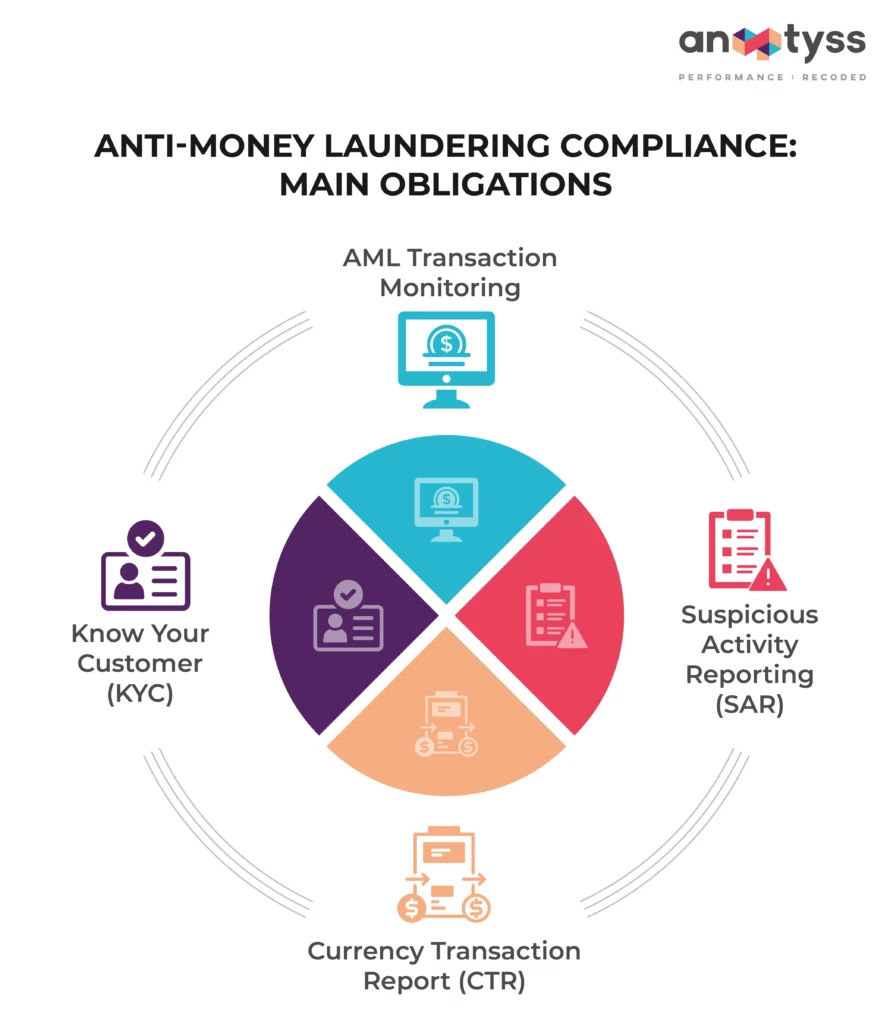

Anti-Money Laundering Compliance: Main Obligations

AML laws obligate banks to conduct specific processes and due diligence concerning customer onboarding, ongoing business, transaction monitoring, sanctions screening, reporting, etc.

1. Know Your Customer (KYC)

As part of KYC, banks need to verify and ascertain the identity of their customers. The goal of KYC is to ensure that their customers are real and not involved in any unethical activities. The KYC processes span three elements viz. customer identification program (CIP), customer due diligence (CDD), and enhanced due diligence (EDD).

The CIP process involves collecting customer information such as name, date of birth, address, identification, etc. CDD processes involve establishing the customer’s credentials and risk profile to determine linkage with potential suspicious activities. Banks conduct EDD for customers with high-risk profiles exposed to heightened risks of money laundering and other financial crimes.

2. AML Transaction Monitoring

Banks need to monitor financial transactions to detect suspicious activities. Automated transaction monitoring systems identify suspicious transactions based on predefined criteria indicative of money laundering, fraud, or terrorist financing activities.

Patterns of suspicious activities can include abrupt or large transactions, repetitive wire transfers, multiple accounts, etc. The systems continuously monitor all transactions and automatically flag transactions that match the defined criteria.

3. Suspicious Activity Reporting (SAR)

Banks are required to report to the Financial Crimes Enforcement Network (FinCEN) any suspicious transactions that are suggestive of money laundering, terrorist financing, or other financial crimes.

Financial institutions must also have robust internal controls in place to identify and report suspicious activity, conduct investigations, and file the SAR.

4. Currency Transaction Report (CTR)

The purpose of CTR is to highlight potential money laundering activities by reporting currency transactions that are greater than $10,000.

Notably, banks can also file the CTR for transactions that appear to be deliberately capped lower than the threshold amount but make a suspicious pattern.

Setting Up an AML Compliance Program

The following are the major components of an anti-money laundering program that can help banks hamper illegal funds from entering the financial system or detect them swiftly:

1. Designate a Compliance Officer

Having a dedicated compliance officer accountability will help ensure focus on strategy and implementation of the BSA/AML/CFT program. It will also bring in the necessary domain expertise and oversight for a robust system.

2. Conduct Risk Assessment

An early step in setting up an AML compliance program is to conduct a routine risk assessment. This aspect is crucial to identifying money laundering and terrorist financing risks associated with a bank’s products, services, customers, geographical locations, and prevailing laws and regulations.

3. Develop Robust Policies and Procedures

Based on the risk assessment results, banks need to develop policies and procedures to address the identified risks. These policies and procedures should include compliance requirements such as rigorous recordkeeping, filing of suspicious activity reports, customer identity verification, etc.

4. Provide Employee Training

Impart training to the employees on policies and procedures of the AML compliance program so that they understand their responsibilities and can identify and report suspicious activities proactively.

5. Conduct Independent Tests and Audits

Conduct regular independent testing of the AML compliance program to build real-world effectiveness based on identifying and addressing potential gaps and weaknesses.

Countering Money Laundering with Domain Expertise

As criminals seek new ways to inject illegal funds into financial systems, banks must detect and prevent such activities.

Domain expertise and technology intervention have gained more relevance in strengthening anti-money laundering in the banking industry. At Anaptyss, we leverage our expertise in areas of AML compliance, ranging from case investigation to AML program audit/design and implementation.

For instance, Anaptyss has helped set up a consultative BSA/AML-focused risk mitigation program for a US-based community bank to meet the FDIC directives.

Interested in more specific guidance for AML compliance? Write to us: info@anaptyss.com.