Basel Norms, issued by the Basel Committee on Banking Supervision (BCBS), are global banking regulations designed to fortify the international banking system. Basel I, Basel II, Basel III, and Basel IV set standards for credit risk, capital requirements, and risk management, ensuring banks are better prepared for financial stresses and operational risks. These guidelines help banks maintain sufficient reserves and enhance corporate governance.

Basel Norms or Basel Accords are the international banking regulations issued by the Basel Committee on Banking Supervision – BCBS. The Norms are an effort to coordinate banking regulations across the globe, to strengthen the international banking system.

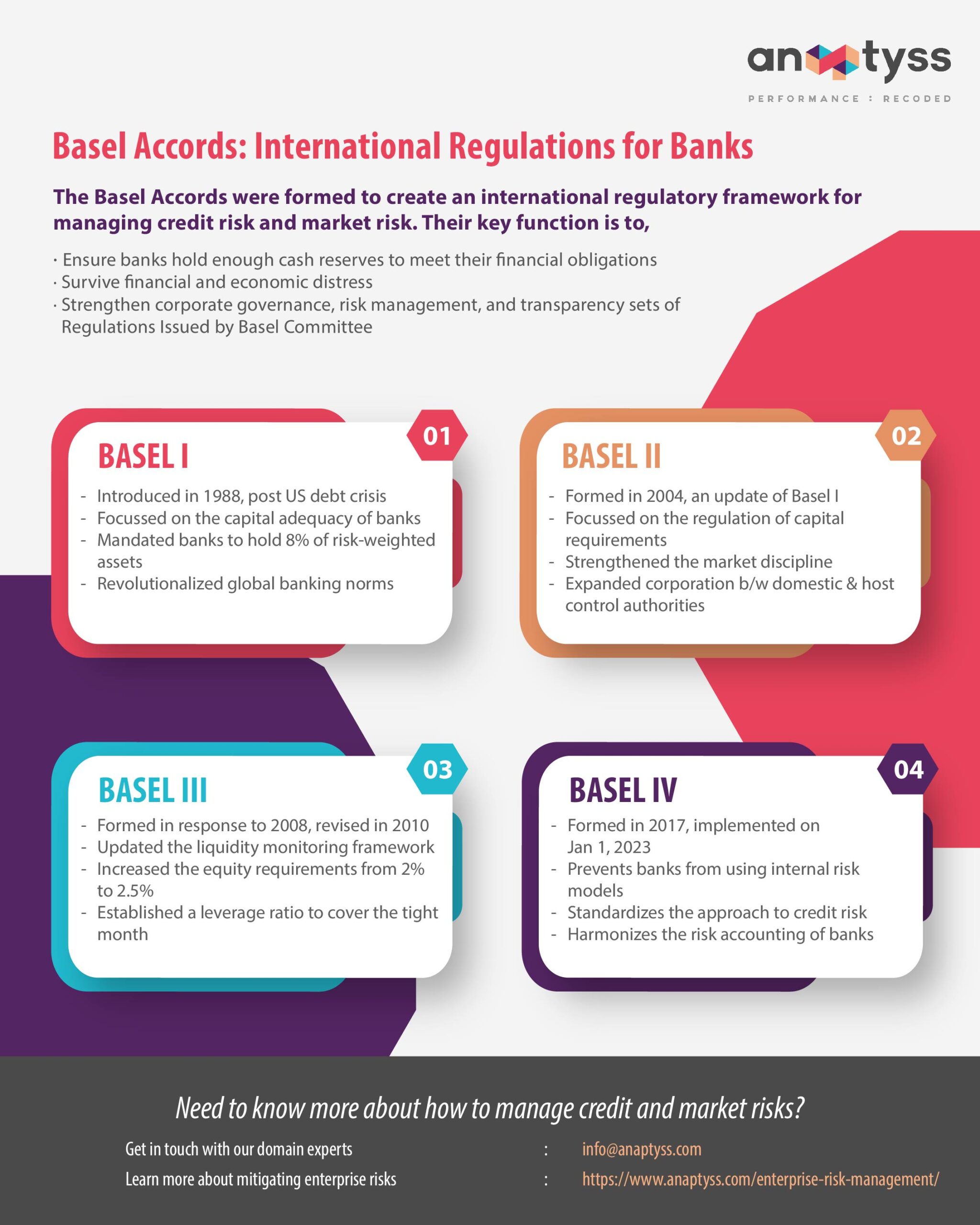

The Basel Committee has issued four sets of regulations known as:

1. Basel I: The First Accord Issued in 1988

This accord aimed to tackle credit risk. With this accord, BCBS established a bank asset classification and lowered many risk profiles, which boosted investments. This paved the way for the best practices and regulations in the banking sector.

2. Basel II: The Second Accord Issued in 2004

The major aim of this accord was to strengthen capital requirements and set up the regulatory review framework. This accord targeted to make banks’ capital more risk-sensitive, promote risk management for large banks, and establish standardized techniques and approaches to evaluating banks in non-EU countries.

3. Basel III: The Third Accord Issued in 2010

This accord came as a response to the global financial crisis. It aimed at reforming and enhancing the regulation, supervision, and risk management within the entire banking sector. Based on the two previous Basel Accords, Basel III focused on individual banks’ ability to withstand financial stresses and mitigate system-wide shocks.

4. Basel IV: The Fourth Accord Issued in 2017

This accord also known as Basel 3.1 refers to the conclusion of the Basel 3 reform package which had taken more than a decade to develop. Basel Committee published finalized rules covering major issues associated with Risk Weighted Assets (RWA). These rules outline fundamental changes to calculate the capital ratio and Risk Weighted Asset by all banks, regardless of the size or complexity of their banking model.

Why Were Basel Norms Formed?

The Basel Norms were formed to create an international regulatory framework for managing credit risk and market risk. Their key function is to ensure that banks hold enough cash reserves to meet their financial obligations and survive financial and economic distress. They also aim to strengthen corporate governance, risk management, and transparency.

The guidelines are the most comprehensive regulations governing the international banking system. The Basel Accords comprises Basel I, Basel II, Basel III, and Basel IV.

The Basel Committee on Banking Supervision – BCBS is the primary global standard setter for the prudential regulation of banks and provides a forum for regular cooperation on banking supervisory matters.

History of the Basel Committee

The Basel Committee—initially named Committee on Banking Regulations and Supervisory Practices—was established by the central bank Governors of the group of 10 countries at the end of 1974.

It was established to enhance financial stability by improving the quality of banking supervision worldwide and to serve as a forum for regular cooperation between its member countries on banking supervisory matters.

The committee is headquartered at the Bank for International Settlements (BIS) in Basel, Switzerland.

The Bank for International Settlements (BIS) is an International financial institution owned by central banks that fosters international monetary and financial cooperation and serves as a bank for central banks. BIS’s mission is to serve central banks in their pursuit of monetary and financial stability.

Established in 1930, the BIS is owned by 62 Central Banks, representing countries from around the world that account for 95% of world GDP.

Complying with Basel Norms: Domain-Centric Approach

Compliance with Basel Norms is important to protecting banks from financial and operational risks. An in-depth understanding of the banking domain and applicable regulatory mandates is crucial to drafting effective control frameworks and internal policies.

Additionally, digital technologies have a significant role in assisting and augmenting manual efforts. A domain-centric approach with digital solutions can provide an optimal strategy.

Want to learn more about Basel Accords and compliance strategies? Write to us: info@anaptyss.com.