The financial world is constantly evolving, with innovations such as digital currencies, decentralized finance (DeFi), and blockchain transforming how transactions occur. However, these advancements also bring new complexities in combating financial crimes

Recent high-profile cases, like large-scale cryptocurrency laundering operations and cross-border money-laundering scandals, have highlighted vulnerabilities in traditional transaction monitoring systems. As financial crimes grow in sophistication, institutions are facing mounting pressure to adapt their monitoring strategies.

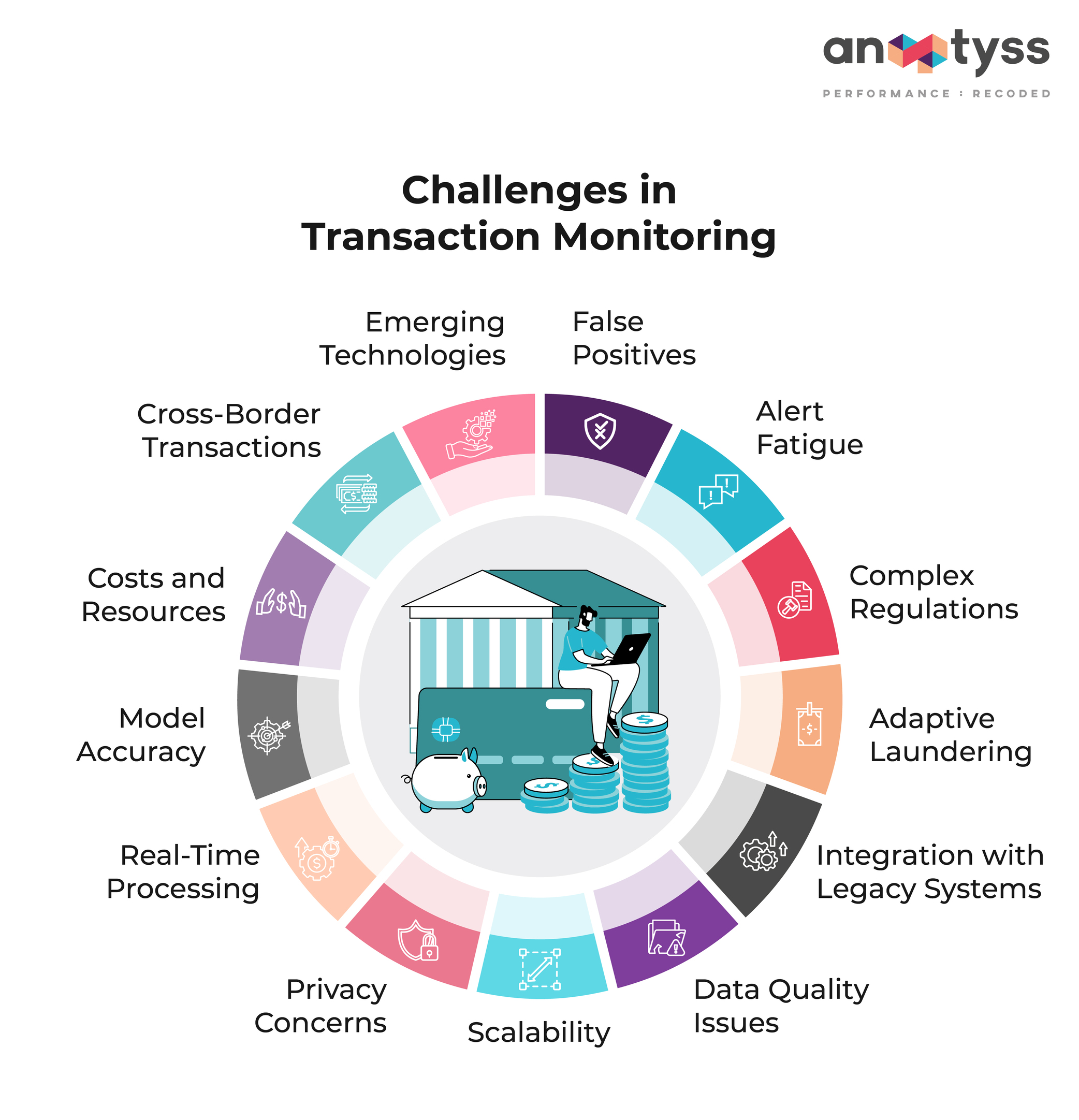

This blog explores the critical challenges faced in transaction monitoring today.

-

False Positives

One of the most significant challenges is the high number of false positives. Many alerts generated by transaction monitoring systems turn out to be benign, leading to unnecessary investigations and increased operational costs.

Excessive false positives can lead to

- Mismanagement of resources

- Overwhelm compliance teams

- Delay the investigation of genuine threats

However, implementing machine learning-based systems can help, as discussed in High Costs of AML Transaction Monitoring: Can Machine Learning Help

-

Alert Fatigue

The sheer volume of alerts can overwhelm investigators, leading to alert fatigue. This may result in important alerts being overlooked or not given the necessary attention.

Alert fatigue can result in:

- Investigators becoming desensitized to critical alerts

- Reduced productivity of compliance teams

- Increased chances of missing genuine suspicious transactions

-

Complexity of Regulations

Financial institutions operate in a highly regulated environment. Adapting transaction monitoring systems to comply with evolving regulations can be challenging and may require continuous updates to rules and models.

Complex regulatory environments can cause:

- Difficulty in keeping up with evolving standards

- High costs associated with compliance adjustments

- Increased risk of non-compliance penalties

-

Adaptive Money Laundering Techniques

Criminals constantly evolve their techniques to bypass transaction monitoring systems. They may employ sophisticated methods to disguise illicit transactions, making it challenging for systems to keep up.

Adaptive laundering techniques can lead to:

- Financial institutions falling behind emerging threats

- Increased sophistication in concealing illicit activities

- Greater reliance on advanced tools and algorithms to stay ahead

Evolving threats like transaction laundering require sophisticated approaches. Insights into these risks are covered in Transaction Laundering: A Growing Threat to AML Compliance.

-

Integration with Legacy Systems

Integrating modern transaction monitoring systems with existing legacy systems can be complex and time-consuming. Legacy systems may lack the flexibility and features needed for effective transaction monitoring.

Integration challenges can result in:

- Data silos that hinder comprehensive analysis

- Delays in adopting advanced monitoring technologies

- Higher costs for system upgrades and maintenance

-

Data Quality and Consistency

Poor data quality and inconsistency in data sources can hinder the accuracy of transaction monitoring. Incomplete or inaccurate information may lead to incorrect risk assessments.

Data quality issues can result in:

- Reduced accuracy in detecting suspicious activities

- Misclassification of high-risk transactions

- Ineffective decision-making based on flawed data

-

Scalability

As financial institutions grow, the volume of transactions increases. Ensuring that transaction monitoring systems can scale to handle large datasets and growing transaction volumes is a constant challenge.

Scalability challenges can lead to:

- Delays in processing large transaction volumes.

- Inability to analyze historical and real-time data simultaneously.

- Infrastructure limitations affecting system performance.

-

Privacy Concerns

Balancing the need for effective transaction monitoring with customer privacy concerns is challenging. Institutions must navigate regulatory requirements and customer expectations to strike the right balance.

Privacy concerns can lead to:

- Customer distrust due to perceived invasions of privacy.

- Compliance challenges with regulations like GDPR.

- Over-reliance on anonymized data that may reduce monitoring accuracy.

-

Real-Time Processing Requirements

Achieving real-time processing capabilities for transaction monitoring can be technically challenging. It requires robust infrastructure and may face latency issues, especially in legacy systems.

Real-time processing requirements can cause:

- Latency in identifying and responding to threats.

- Increased infrastructure costs for high-speed systems.

- Technical challenges in integrating real-time monitoring with batch systems.

-

Model Accuracy and Tuning

Machine learning models used in transaction monitoring require continuous tuning to adapt to changing patterns. Ensuring the accuracy and reliability of these models can be demanding.

Model accuracy issues can lead to:

- Misidentification of legitimate transactions as suspicious.

- Failure to detect evolving criminal patterns.

- Increased costs and time spent on frequent model retraining

-

Costs and Resource Allocation

Implementing and maintaining an effective transaction monitoring system involves significant costs, including technology, human resources, and ongoing training. Financial institutions must allocate resources wisely to address these challenges.

Cost and resource allocation issues can lead to:

- Budget constraints limiting system enhancements.

- Inadequate staffing for monitoring and investigations.

- Delayed adoption of cutting-edge technologies

-

Cross-Border Transactions

Monitoring transactions that involve multiple jurisdictions can be complex due to differing regulatory requirements and challenges in coordinating efforts across borders.

Cross-border transaction challenges can result in:

- Difficulty complying with varying regional laws.

- Delays in identifying suspicious cross-border activity.

- Increased risk from lack of transparency in offshore transactions

Learn more about navigating these complexities in Correspondent Banking and AML Risks.

-

Emerging Technologies

Keeping up with emerging technologies and incorporating them into transaction monitoring systems is a perpetual challenge. This includes leveraging advancements in artificial intelligence, machine learning, and data analytics.

Emerging technology challenges can lead to:

- Resistance to adopting unfamiliar systems.

- Skills gaps in existing compliance teams.

- High initial investment costs for integrating new solutions

Additionally, evolving threats such as transaction laundering demand more sophisticated approaches. Insights into these risks are covered in Transaction Laundering: A Growing Threat to AML Compliance.

Conclusion

Tackling the challenges of transaction monitoring in today’s rapidly evolving financial landscape demands a comprehensive, proactive approach. Financial institutions must leverage advanced technologies, embrace regulatory expertise, and implement continuous monitoring to stay ahead of emerging threats.

For deeper insights into how the financial industry can navigate the complexities of cryptocurrency and strengthen defenses against financial crimes, download our whitepaper: Mitigating Financial Crime Risks in the Age of Cryptocurrency.