This blog delves into the importance of credit risk management, highlighting the key challenges, types of credit risks, and best practices for banks to mitigate potential losses. It provides a comprehensive guide on effective strategies, emerging trends, and the critical 5 Cs of credit risk management, ensuring long-term financial stability and regulatory compliance for financial institutions.

Credit risk is a major financial risk that occurs when a borrower or entity fails to repay the owed principal and interest to the bank or financial institution. Payment defaults may occur on credit cards, mortgages, fixed-income securities, etc. It is a significant concern for financial institutions and investors as it can lead to:

- Financial losses

- Disrupt cash flows

- Increase collection rates

- Adversely affect the stability of the institution

- Negatively impact the liquidity of the institution

Therefore, banks and financial institutions must manage credit risks by analyzing the borrower’s creditworthiness.

The blog overviews credit risk management, credit risks, the five Cs to measure credit risks, associated challenges, and the best practices to manage and mitigate credit risks.

What is Credit Risk Management?

Credit risk management is one of the most critical components in the banking sector, essential to maintaining the financial stability of banks and preventing financial and reputational losses. It also helps ensure that banks and financial institutions can continue to lend mortgages or loans to individuals and businesses.

Credit risk management involves preventing, detecting, identifying, measuring, monitoring, and mitigating different credit risks.

Regulatory Guidelines for Credit Risk Management in Banks

After the 2007-2008 financial crisis, the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and other regulatory bodies implemented stringent rules for the banks. These rules were formed to ensure adequate risk management protocols.

The crisis also highlighted the necessity of effective credit risk management practices in the banking sector for maintaining compliance and safeguarding the banking system.

The Dodd-Frank Wall Street Reform and Consumer Protection Act was also passed in response to the financial crisis in 2007-2008 to make the US financial system safer for consumers and protect them from egregious practices like predatory lending. Enacted in 2010, the act introduced several guidelines to improve credit risk management in the financial industry. These include:

- Stress Testing

Requires banks and financial institutions to conduct regular stress tests to evaluate their ability to withstand adverse financial conditions. - Risk Retention

Risk-retention requires securitizers to retain a portion of credit risk linked to securitized assets. - Volcker Rule

Restricts the banks from engaging in proprietary trading and high-risk investment activities. - Systemic Risk Oversight

Established Financial Stability Oversight Council (FSOC) to identify and address systemic risks in the financial system.

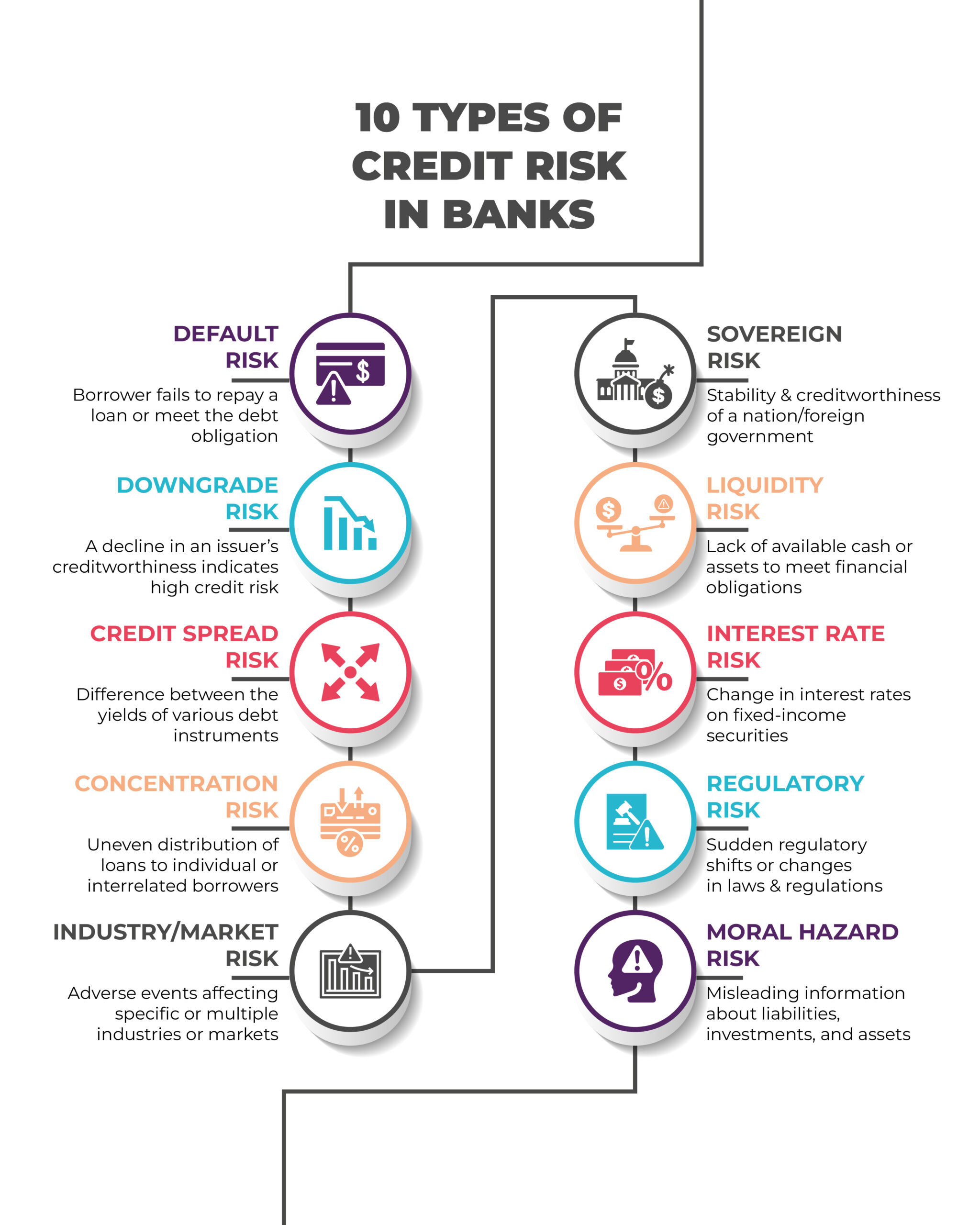

10 Types of Credit Risk in Banks

To effectively manage credit risk, it is essential to understand the different types of credit risks.

1. Default risk

When a bank grants a loan or mortgage to a borrower, there is a probability that the loan or a part of it (principal or interest) remains unpaid. It is a well-known and fundamental credit risk type where a borrower does not repay their loan or fails to meet the debt obligation, such as a loan, credit card, or bond. Credit default incurs monetary losses for the bank or financial institution.

2. Downgrade Risk

Credit rating agencies help banks and financial institutions evaluate the issuer’s creditworthiness. Downgrade risk occurs when an issuer’s rating is downgraded by credit rating agencies, indicating a higher level of credit risk. Agencies lowering or downgrading the rating can increase borrowing costs and potential losses for banks and financial institutions.

3. Credit Spread Risk

Credit spread risk refers to the changeability or potential for the difference between the interest rates of the borrower’s debt and risk-free return rates or government bonds. A wider spread indicates an increase in credit risk, which can lead to financial losses for banks and stakeholders.

4. Concentration Risk

This risk occurs due to a bank’s exposure to a specific industry sector, borrower, or region. This can increase the vulnerability to adverse events that can impact the concentrated positions of the bank or financial institution, leading to significant financial losses.

5. Industry/Market Risk

The risk arises due to adverse events or specific factors that affect a particular industry or market and degrade the value and performance of the investment. Industry or market risks lead to losses for the bank, investors, and financial institutions.

6. Sovereign Risk

These are potential risks associated with the stability and creditworthiness of a nation or a foreign government, which can result in a default on its debt obligations or financial commitments.

7. Liquidity Risk

Liquidity risk is caused by a lack of available cash or marketable assets. It is the risk for the banks and financial institutions where they fail to meet financial commitments and short-term obligations due to a lack of access to sufficient funds.

8. Interest Rate Risk

These are the risks posed by changes in the interest rates that can impact the value and performance of investments, such as fixed-income securities. When the interest rate rises, the value of bonds and fixed-income securities in the secondary market declines, leading to investment losses for banks or financial institutions.

9. Regulatory Risk

It refers to risks of adverse consequences arising from the shifts in regulatory framework or changes in laws, regulations, industry standards, or government policies that may directly or indirectly impact the bank’s or financial institution’s operations and profitability.

10. Moral Hazard Risk

Moral hazard is common in the lending and insurance sector. It refers to a situation wherein a party in a contract provides misleading information about its liabilities, investments, credit capacity, and assets. In this risk, the party may take uncommon risks or decisions to make profits before the contract settles without having to suffer any consequences. This can lead to significant losses to the lender or the bank.

Challenges in Credit Risk Management

Banks and financial institutions encounter several challenges to effectively managing credit risks. These include:

1. Economic Uncertainty

Economic volatility and uncertainty present challenges to credit risk management as they can impact the borrowers’ creditworthiness, making risk assessment and management more challenging.

2. Regulatory Changes

Compliance with Basel III, IFRS 9, and stress testing imposed by regulatory authorities is crucial for financial institutions. However, changing regulatory requirements and accounting standards impact credit risk management.

3. Cybersecurity Risks

Cybersecurity risks are a major concern, which has increased with the digitization of banking and financial services. Cyber-attacks lead to data breaches that can compromise sensitive information.

4. ESG Factors

Environmental, Social, and Governance (ESG) factors are gaining importance in risk management. Therefore, banks and financial institutions must understand and incorporate ESG risks into their credit risk management frameworks to identify potential risks associated with:

- Climate change

- Corporate social responsibility (CSR)

- Corporate governance

5. Data Quality and Availability

Banks often face challenges with critical factors such as data quality, data governance, and availability, which hampers decision-making and accurate risk assessment.

6. Portfolio Concentration

Concentration risk remains one of the major challenges as it leads to significant exposure to a specific sector, region, or borrower that can lead to potential losses.

7. Change in Customer Behavior

Changes in customer behavior can increase the likelihood of defaults. For instance, alteration in their spending habits or financial stability. Similarly, a shift in industry dynamics due to technological disruption or regulatory changes can impact the financial health of the institution and its ability to meet credit obligations.

Best Practices & Strategies for Credit Risk Management in Banks

Effective credit risk management in banks involves a combination of credit risk measurement, policies, and monitoring techniques.

1. Robust Credit Policies and Procedures

Establish comprehensive credit policies and procedures. Also, include clear guidelines for,

- Credit underwriting

- Loan origination

- Risk assessment

2. Robust Underwriting Standards

Implement rigorous credit underwriting standards to efficiently assess borrower creditworthiness and mitigate default risk. This involves a thorough analysis of:

- Borrowers’ financials

- Collateral valuation

3. Diversify Credit Portfolios

A well-diversified credit portfolio helps minimize concentration risk. By spreading credit exposures across various industries or sectors, and borrower types, financial institutions can reduce the impact of adverse events and prevent potential losses.

4. Stress Testing and Scenario-Based Analysis

Conduct regular stress tests and scenario-based analyses to assess the impact of adverse economic conditions. This helps:

- Identify and detect vulnerabilities

- Evaluate capital adequacy ratio (CAR)

- Develop risk mitigation strategies

5. Risk Rating

Create a separate risk scoring or risk rating method for internal purposes to ensure accurate assessment and classification of the borrowers based on credit quality. It can be designed with qualitative and quantitative factors, such as financial analysis, ratios, etc. This improves

- Credit decision-making

- Detect high-risk borrowers for closer monitoring.

6. Adequate Allowance for Loan and Lease Losses (ALLL)

ALLL helps analyze credit losses in the bank portfolio of loans and leases. It ensures that banks have sufficient funds to cover potential credit losses. By maintaining appropriate ALLL, banks and financial institutions can estimate and maintain adequate allowances.

7. Skilled Credit Risk Management Team

Build a skilled credit risk management team with diverse skill sets, including statistical modeling, risk assessment, and data analysis. For this, banks and financial institutions can:

- Hire experienced credit officers, loan underwriters, analysts, etc., with strong analytical and industry knowledge

- Identify skill gaps

- Focus on continuous workforce skilling and upskilling.

- Assess expertise and capabilities.

Banks can leverage digital learning solutions to provide a sustainable, efficient, and measurable way to train the workforce in credit risk management.

8. Take Advantage of AI, ML, & Data Analytics

Use advanced technologies and intelligent digital solutions to establish a robust reporting and analytics framework. This helps banks gain insights into their:

- Credit risk exposures

- Portfolio performance

- Emerging trends

It also helps ensure accurate and timely reporting for informed decision-making and effective credit risk mitigation.

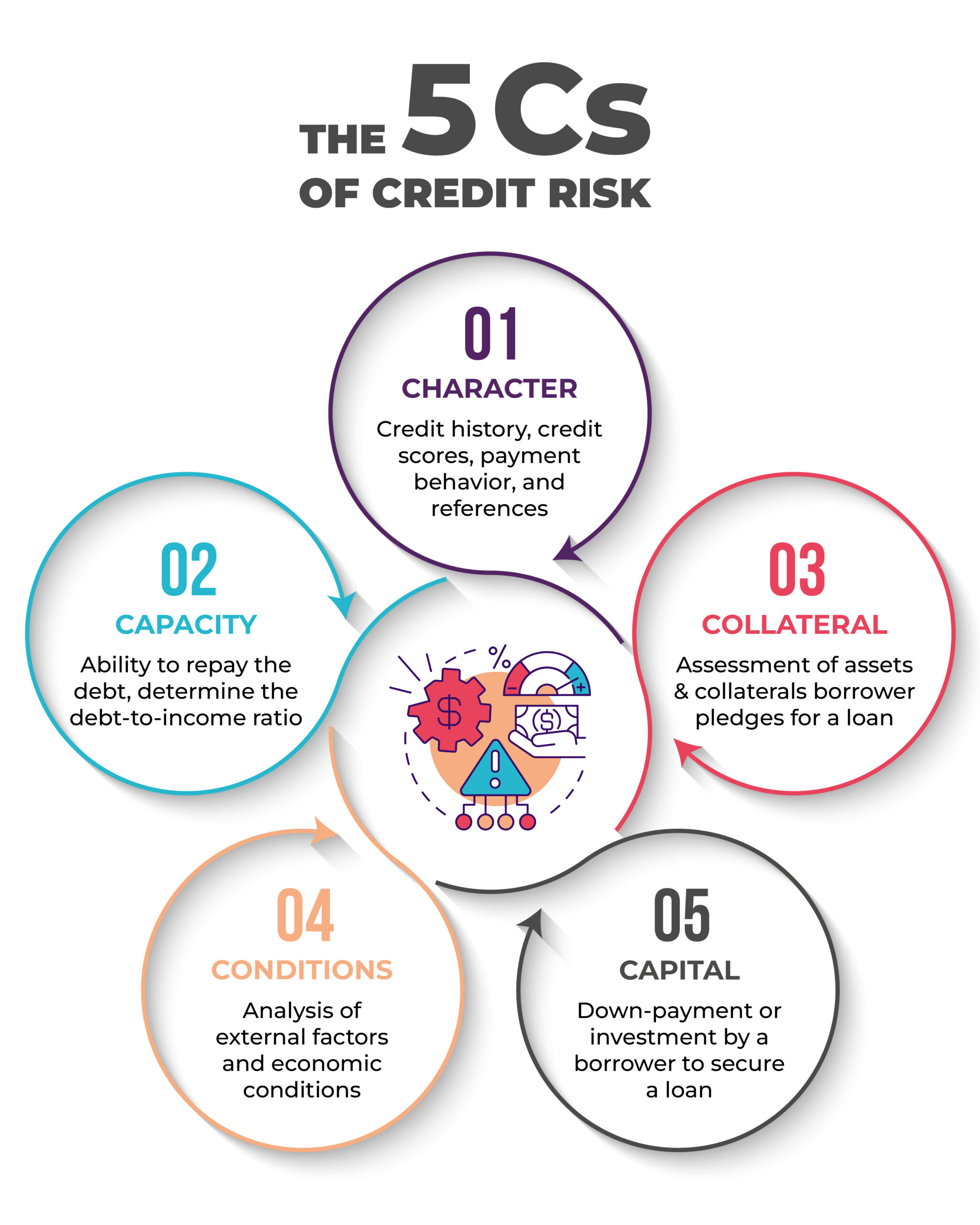

The 5 Cs of Credit Risk Management

The Five Cs of Credit Risk Management enables banks and financial institutions to measure the borrower’s creditworthiness by evaluating the following:

1. Character (or Credit History)

Banks and financial institutions need to look into the borrower’s reputation or record related to financial matters. To determine this, banks can look for credit scores, credit history, payment behavior, and references to analyze their integrity and willingness to repay the loan.

2. Capacity

To ensure the borrower’s ability to repay the debt, banks and financial institutions need to look for indicators, such as their income, cash flow, and financial and employment stability. For organizations, banks need to look at their cash flow statements to determine the debt-to-income ratio and efficiency in paying back the debts from their income.

3. Collateral

It includes an assessment of assets or collateral submitted by the borrower to secure a loan. Banks and financial institutions or lenders should assess the value and marketability of submitted collaterals and assets to mitigate credit risk and safeguard themselves in case the borrower stops making the payments or defaults.

4. Conditions

The assessment of external factors may impact the terms of the loan and the borrower’s ability to repay the debt. Evaluating the suitability of the terms and economic conditions for a borrower’s needs and financial situation. The “conditions” parameter is evaluated qualitatively, and it is one of the most subjective of the five Cs.

5. Capital

Banks and financial institutions need to evaluate borrower’s financial resources and equity by considering factors such as

- Borrower’s net worth (savings, investments, account balances, etc.)

- Assets and collaterals

- Liabilities or debts

Banks and lenders must consider these factors and subtract overall liabilities from total assets to determine the capital position of the borrower.

Emerging Trends in Credit Risk Management

Some notable emerging trends in credit risk management include:

- Use of intelligent digital solutions

- Artificial intelligence

- Machine learning

- Data Analytics

These solutions help banks and financial institutions:

- Improve credit risk measurement and monitoring

- Leverage advanced analytics capabilities

- Improve risk modeling

With big data technologies, banks can process unstructured data from various reliable data sources to gain deeper insights into credit risk.

In addition, ESG factors have become increasingly important, prioritizing addressing climate risk and incorporating sustainable lending practices into credit risk management frameworks.

Conclusion

Credit risk management is a fundamental aspect of banking operations with a continuously changing regulatory landscape. Effective credit risk management helps banks ensure long-term financial stability and regulatory compliance. This comprehensive guide serves as a roadmap for banks and financial institutions, providing valuable insights, strategies, and best practices for credit risk management.

For more information on credit risk management, write to us: info@anaptyss.com