A single credit misjudgment can jeopardize a bank's financial health and reputation. In an industry where lending forms the backbone of operations, mastering credit risk management is paramount. This article delves into the essential processes, best practices, and innovative techniques that banks can employ to assess and mitigate credit risks effectively, ensuring robust financial health and sustained profitability.

Credit risk, the potential for financial loss resulting from a borrower’s failure to repay a loan, is a fundamental challenge in banking. It can manifest in many forms, including loan defaults, liquidity shortfalls, and moral hazards. While these risks are inherent to lending, systematic credit risk management can significantly curtail and mitigate them.

This guide sheds light on the essential processes, best practices, and techniques that form the bedrock of a resilient credit risk management framework.

The Core Principles of Credit Assessment

Effective risk management begins with a thorough assessment of every potential borrower. This involves two key practices.

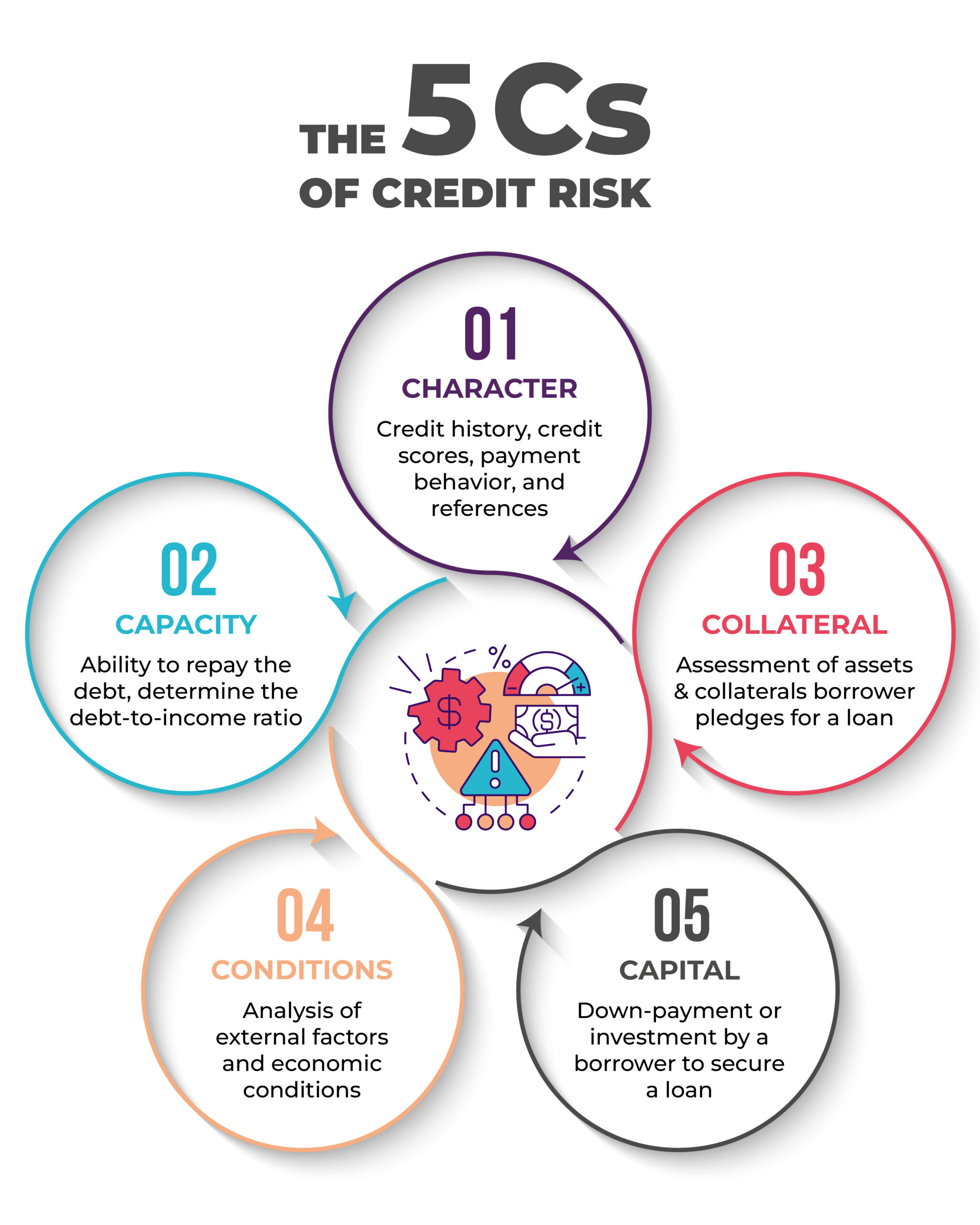

1. Consider the 5Cs of Credit Risk

The 5Cs provide a foundational framework for evaluating the creditworthiness of a borrower and identifying inherent risks.

- Character

Evaluates the borrower’s credit history, payment behavior, and references to gauge their reputation and reliability. - Capacity

Determines the borrower’s ability to repay the debt, primarily by assessing their debt-to-income (DTI) ratio. - Collateral

Evaluates the assets a borrower pledges as security for a loan, which is essential for credit risk mitigation. - Conditions

Analyzes the purpose of the loan, the amount involved, and external economic factors that could impact repayment. - Capital

Refers to the down payment or personal investment a borrower makes, indicating their financial commitment and cushioning potential losses.

2. Establish Robust Underwriting Standards

Stringent, well-defined underwriting standards ensure that only eligible, low-risk applicants are approved for loans. This practice safeguards against excessive risk and helps determine the appropriate loan amount, terms, and interest rates. While the FDIC doesn’t set specific standards, its guidelines emphasize:

- Evaluating the applicant’s repayment willingness and capacity.

- Reviewing credit history and performance on past obligations.

- Assessing all sources of income.

- Considering the borrower’s overall relationship with the bank.

Developing a Resilient Credit Risk Framework

Beyond individual assessments, a successful strategy relies on a robust institutional framework.

3. Implement Clear Credit Policies & Procedures

A formal credit policy is the foundation of effective risk management. It should provide well-defined criteria and clear guidelines for making lending decisions, outlining the terms of sale, credit extension procedures, and the collections process.

4. Maintain Adequate Allowance for Loan and Lease Losses (ALLL)

The ALLL (originally the ‘reserve for bad debts’) is a crucial buffer to absorb estimated credit losses within a bank’s loan portfolio. Maintaining an adequate ALLL ensures that the institution has sufficient funds to cover potential defaults without jeopardizing its financial stability.

5. Build a Skilled Credit Risk Management Team

An effective framework requires a skilled team with diverse capabilities in risk assessment, statistical modeling, and data analysis. Banks must invest in hiring experienced professionals and providing continuous workforce training through digital learning solutions to address skill gaps and keep the team updated on emerging threats and technologies.

Ongoing Monitoring and Analysis Techniques

Credit risk is not static. Continuous monitoring is essential to identify and manage emerging risks.

6. Implement Continuous Credit Risk Monitoring

Regularly assessing changes in a borrower’s risk profile is crucial. This involves periodic credit assessments, account reviews, and timely follow-ups on overdue payments to get early alerts on potential issues like a declining credit score, a new lawsuit, or a bankruptcy filing.

7. Conduct Stress Testing and Scenario Analysis

These forward-looking techniques help banks understand their vulnerabilities. For a deeper understanding, explore the role and importance of stress testing in credit risk management.

- Stress Testing — Assesses the bank’s ability to withstand severe, institution-wide adverse economic conditions.

- Scenario Analysis — Analyzes the impact of more specific economic events or scenarios to estimate potential losses and identify areas of concern.

8. Leverage New-Age Technologies

By using intelligent digital solutions powered by AI, machine learning, and big data analytics, banks can gain deeper insights into their credit risk exposure. Technology is key to understanding how AI is reshaping credit risk analytics and portfolio performance.

Effective Credit Risk Mitigation Techniques

When risk is identified, banks can use several techniques to minimize its potential impact.

9. Diversify Portfolios

Avoiding credit concentration in a few specific customers, industries, or sectors is a fundamental mitigation technique. By creating a well-diversified credit portfolio, banks can reduce the impact of an adverse event affecting a single area. This is a core component of modern credit portfolio management.

10. Use Collateral for Security

Requiring customers to provide assets as collateral can significantly reduce risk exposure. If a borrower defaults, the lending institution can seize and sell the collateral to recover its losses.

11. Obtain Credit Insurance

Credit insurance policies offer an additional layer of protection by covering a significant percentage of losses that may occur due to borrower defaults.

12. Implement Effective Collection Strategies

Proactive and effective collection strategies can greatly reduce credit losses. This includes regular follow-ups on overdue payments, offering flexible payment plans where appropriate, and maintaining open communication with borrowers.

Frequently Asked Questions (FAQ)

- What is the difference between credit risk and market risk?

Credit risk is the risk of loss from a borrower failing to repay a loan. Market risk is the risk of loss from factors that affect the entire financial market, such as changes in interest rates, stock prices, or foreign exchange rates. - What are the main types of credit risk?

The main types include default risk (borrower fails to make payments), concentration risk (too much exposure to a single borrower or sector), and country risk (risk associated with a foreign country’s political or economic instability). - How does technology help in credit risk management?

Technology, especially AI and machine learning, automates data analysis, improves the accuracy of credit scoring models, provides real-time monitoring of portfolios, and helps identify complex risk patterns that would be missed by manual processes.

Conclusion

Robust credit risk management is a dynamic, continuous process. It relies on a comprehensive lifecycle of assessment, building a strong framework, continuous monitoring, and proactive mitigation. By implementing the best practices discussed in this guide, banks and financial institutions can significantly improve their strategies, protect themselves from potential losses, and ensure long-term stability and success.

Looking for expertise in credit risk management. Contact us: info@anaptyss.com.