Our previous blog discussed how access to Generative AI (GenAI) capabilities has enabled new-age threat actors and criminals to carry out various highly sophisticated fraud and financial crime schemes – and how financial institutions can detect and combat GenAI-enabled frauds.

In this blog, you will learn how financial institutions can also use the GenAI capabilities to transform their traditional rule-based systems and static models with models powered by artificial intelligence (AI) and machine learning (ML) to combat financial crime, such as money laundering, terrorist financing, and fraud.

You can also explore strategies to enhance efficiency in financial crime compliance programs with advanced analytics, skill development, and risk-based approaches.

Limitations of Traditional Financial Crime Compliance Processes

While technology is evolving, many banks and financial institutions still rely on their traditional systems for compliance with financial crime. However, these systems have many limitations, such as:

- Static, Rule-based System

Traditional systems and processes are often based on predefined rules and procedures to detect fraud and financial crime. However, these quickly become outdated and inefficient in the era of emerging threats.

- False Positives

Rule-based systems are known to trigger high rates of false positives. As a result, it leads to inefficiencies and makes the team manually investigate each non-issue (false positives), often redirecting or diverting the resources from actual threats.

- Manual Processes

Manual review processes for alerts are always labour-intensive, time-consuming, and prone to human error. For more insights on these challenges, read What is Financial Crime Compliance.

- Inability to Keep up with Rapid Change

Static systems often struggle to keep pace with the evolving financial crime scenarios and sophisticated fraud schemes, especially those enabled by emerging technologie,s such as AI, machine learning, GenAI, etc., leaving financial institutions and banks vulnerable.

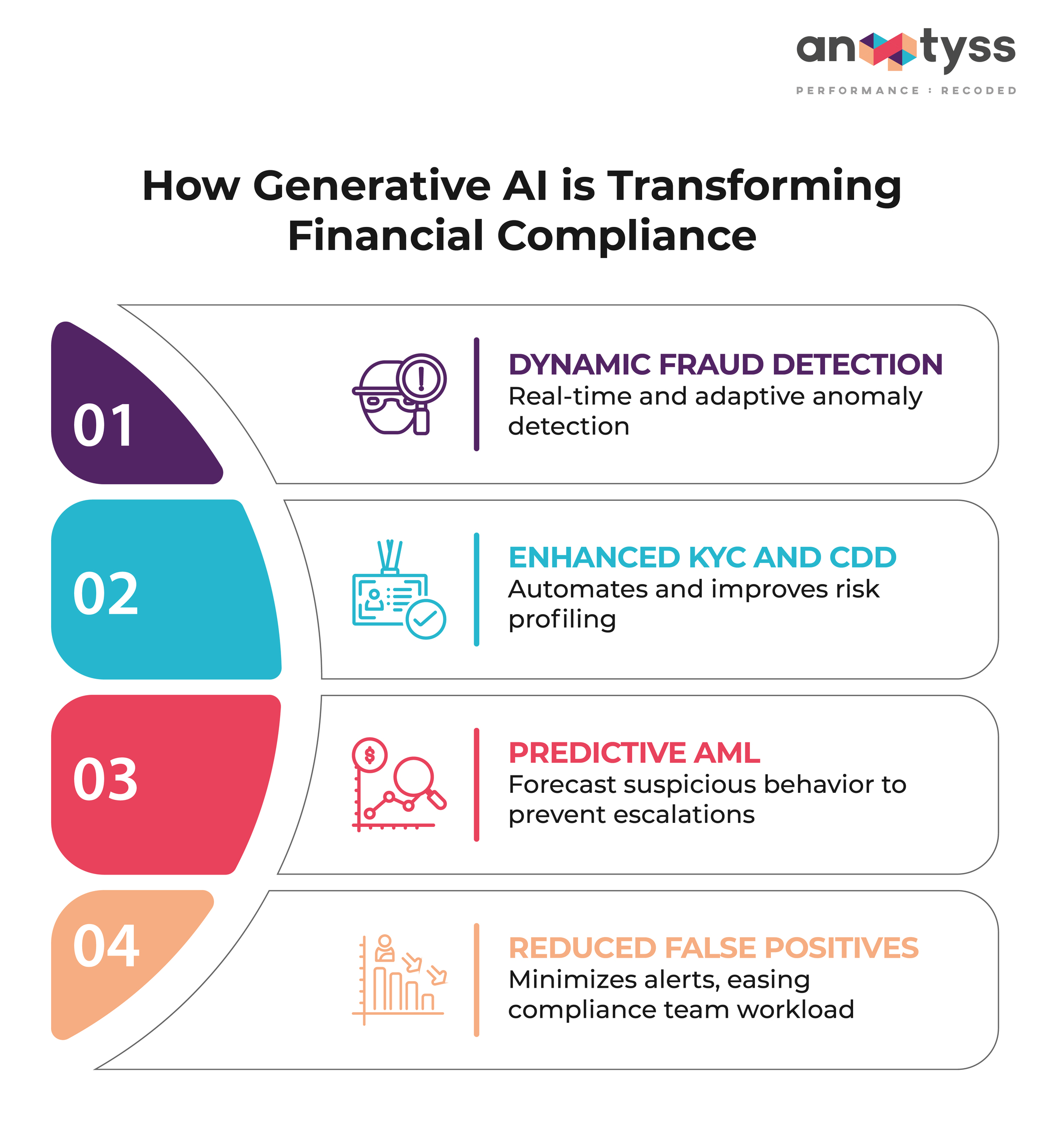

Role of Generative AI in Transforming Financial Crime Compliance

Generative AI is set to redefine the fundamental game of financial crime and fraud detection and prevention with its unprecedented advanced capabilities. Here’s how:

- Dynamic Fraud Detection Models

With GenAI, financial institutions can create a fraud detection model that continuously learns from real-time and historical patterns. Unlike static rule-based fraud and financial crime detection systems, these AI and machine learning-powered models can quickly adapt to new and emerging threats and help safeguard institutions with highly accurate proactive detection capabilities.

For example, some financial crime typologies, such as money laundering, synthetic identity, KYC impersonation, etc. are evolving rapidly. GenAI can help analyze large data sets in real-time, detect anomalies, and flag suspicious activities or patterns with greater accuracy.

- Improved KYC and Customer Due Diligence

Know your customer (KYC) and customer due diligence (CDD) are the fundamentals to prevent financial crimes. With GenAI, financial institutions can automate and improve these processes by analyzing large sets of both structured and unstructured data from, for example, public records, social media, transaction history, etc, to create or generate a more accurate risk profile.

Similarly, by leveraging natural language processing (NLP), GenAI can help boost customer onboarding, identify red flags in the process for further investigation by humans, and help provide a more comprehensive view of customer risk.

- Predictive Capabilities for AML

US banks spend about $25 billion a year on processes to fight money laundering, and fines levied on banks worldwide for failing to prevent it topped $6 billion in 2023 – as per Oracle.

Anti-money laundering compliance (AML) programs traditionally rely heavily on static thresholds in many financial institutions to flag suspicious activities. However, GenAI can enable financial institutions to predict suspicious behaviors and transactions even before they escalate and lead to major issues, such as financial loss and compliance failure.

For instance, AI models can continuously learn and analyze customer behavior, transaction history, and network relationships, and more to predict patterns consistent with money laundering and help reduce the likelihood of financial crime going undetected. For a deeper understanding, explore Financial Crime Risk Management.

- Reduced False Positives

False positives generated by static models and traditional systems are one of the most concerning pain points for financial institutions, especially for compliance teams.

According to PWC, 80% – 90% of transaction monitoring and name screening hits are false positives.

However, GenAI-based models can continuously learn, adapt, and refine their detection mechanisms over time to reduce the likelihood of false positives. This can help drastically reduce the pressure on compliance teams and human resources, helping them focus on more productive and important tasks and dealing with genuine threats.

Conclusion

Generative AI is set to transform financial crime compliance with enhanced capabilities that can efficiently detect fraud, improve customer due diligence processes, automate systems, and significantly reduce the burden of false positives on compliance teams.

The GenAI-enabled models can continuously learn and dynamically adapt to emerging threats and analyze vast amounts of data in real-time with better accuracy and reduced false positives.

To stay ahead in this evolving landscape, financial institutions should act now and start integrating these emerging technologies into their compliance strategies.

At Anaptyss, we provide AI-powered intelligent digital solutions to help banks and financial institutions navigate these challenges effectively. To learn more and know how we can co-create and support your financial crime compliance efforts, reach us at info@naptyss.com

You can also read our eBook on Financial Crime Compliance to learn more about financial crime compliance and strategies in banking.