In this blog, we explore the transformative effects of intelligent automation on commercial loan origination. Traditionally manual and cumbersome, loan origination processes can be streamlined through automation to enhance efficiency, reduce operational costs, and improve customer satisfaction. We discuss the benefits of adopting advanced technologies like machine learning and RPA, which facilitate faster processing, higher accuracy, and better regulatory compliance, fundamentally reshaping the commercial lending landscape.

Commercial loan origination has always been a cumbersome and time-consuming task for any financial institution. Traditional commercial lending methods, with manual tasks and paper-based workflows/underwriting, are becoming inefficient and virtually obsolete because of their slow results, lack of consistency, suitability, accuracy, and time-consuming nature, leading to unhappy customers.

However, intelligent automation of loan origination processes can empower a financial institution to better engage with the borrower and align all the teams involved in loan origination without adding overhead or extra work to relationship managers, approvers, and credit analysts.

As a result, this allows lenders to process applications at a faster pace while significantly bringing down operational costs and driving accuracy and customer satisfaction.

The blog outlines the challenges within the traditional loan origination approaches and some strategic techniques and approaches in which automation could help improve commercial loan origination efficiency.

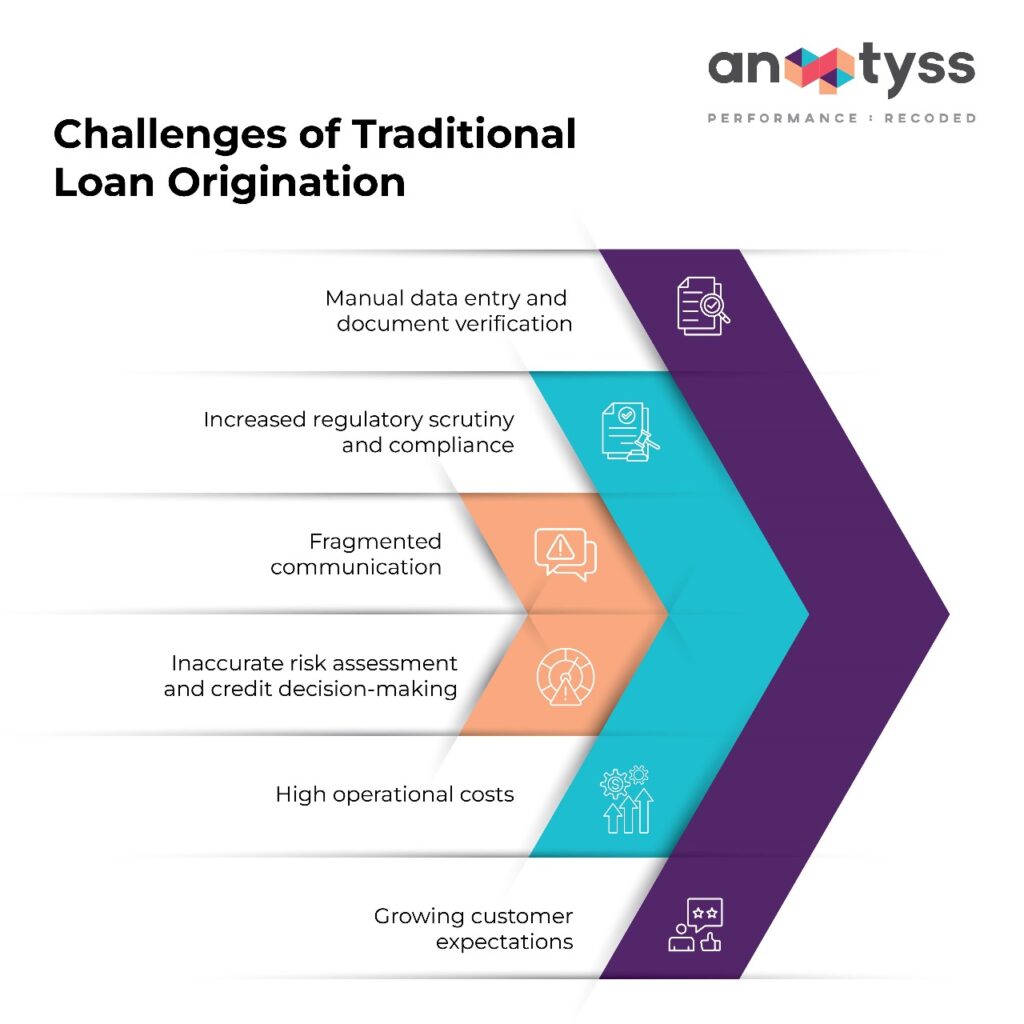

The Challenges of Traditional Loan Origination

Traditional loan origination consists of several manual steps ranging from gathering borrower information to document verification and credit checks and more. All these activities are labor intensive and thus, susceptible and subject to human error. This can lead to delays and increase operational costs.

Some of the key challenges with traditional loan origination processes include:

1. Manual Data Entry, Document Collection, and Verification

Traditional loan originators involve manual data entry and collection of paper documents for verification. Such paperwork-heavy processes are intrinsically slow and prone to errors and delays. This need to move paperwork around physically—sometimes coupled with in-person interactions, adds to further delay.

These inefficiencies can lead to compliance problems or delayed loan approvals, and adverse customer experiences that can negatively affect lenders’ ability to compete in the evolving markets.

2. Increasing Regulatory Scrutiny and Compliance Requirements

Rising regulatory scrutiny and stricter requirements on financial institutions make compliance a more challenging, complex, time-consuming, resource-intensive, and expensive task.

However, financial institutions have no option but to be continuously on their toes and constantly update and modify their internal processes and risk controls to stay abreast of regulatory requirements.

3. Fragmented Communication

The success of any financial institution depends on the customer perception and trust. Today, customers want to stay updated on everything that matters.

However, the lack of a unified or single platform between borrowers, lenders, and third parties leads to fragmented and inconsistent information exchange that slows down the loan origination process to a crawl and delivers a less-optimal customer experience.

4. Inaccurate Risk Assessment and Credit Decision-Making

The traditional methods for risk assessment are usually based on limited data and subjective judgments.

This can lead to poor risk profiling and suboptimal lending decisions. As a result, it increases the possibility of potential defaults, delinquency, and financial losses.

5. High Operational Costs

Manual or traditional paper-heavy and physical processes and methods are inefficient and come with a high operational cost which can erode financial institutions’ profitability and weaken their competitiveness in the market.

In addition, scaling up or modernizing manual or traditional systems and processes requires domain expertise, skilled staff, and resources, which can be cost-prohibitive for many banking and financial institutions.

6. Growing Customer Expectations

Today, customers or borrowers want speed, transparency, and seamlessness in digital experiences. These expectations are difficult to meet with traditional processes that could lead to dissatisfaction and lost business opportunities.

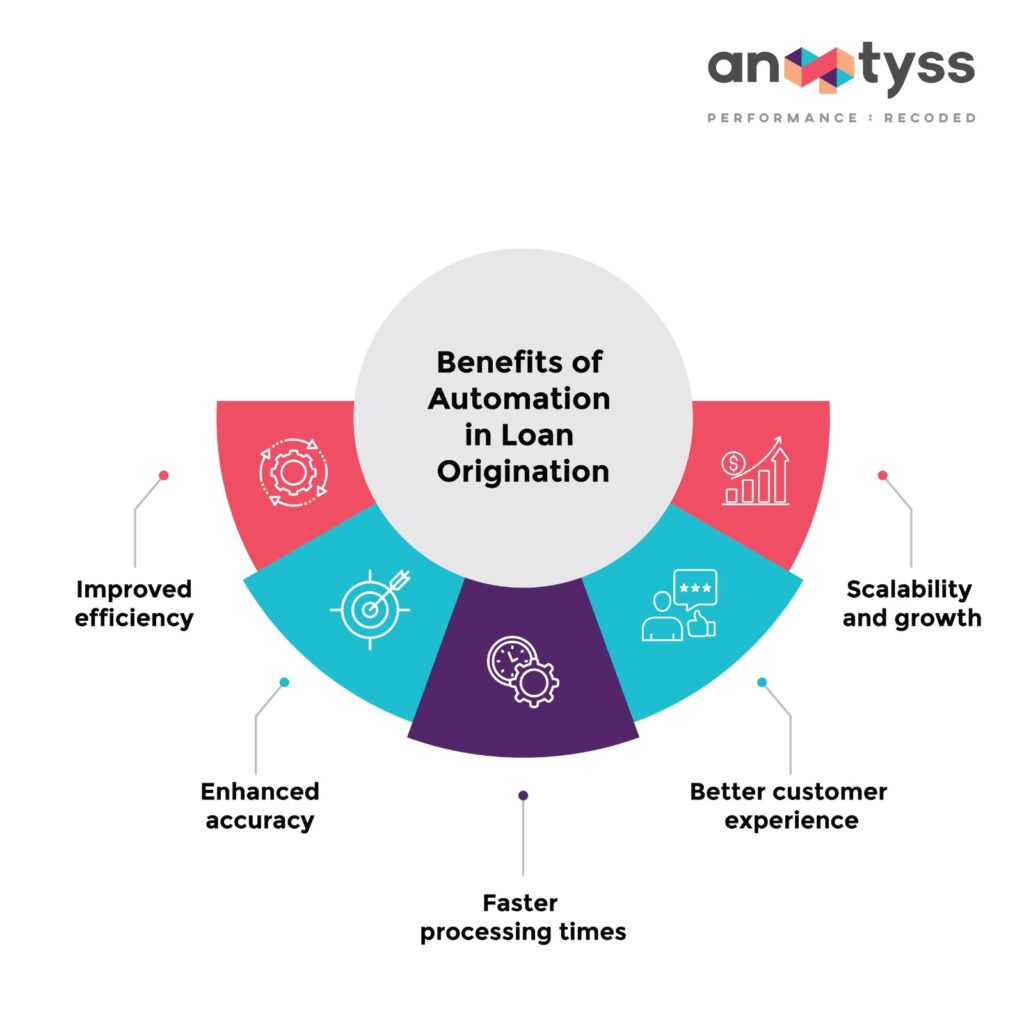

How Automation Can Transform Loan Origination

Intelligent and hyper-automation bring advanced and emerging technologies together to drive efficiency into many steps in the loan origination process using artificial intelligence, machine learning, and RPA.

It can streamline disparate systems and provide reliable and consistent data from all stages of the loan origination process and quicken the workflow.

The following are some of the notable benefits seen from integrating automation into commercial loan originations:

1. Improves Efficiency

It automates some time-consuming processes so that the loan officers shift focus to more convoluted and strategic activities. This includes data collection from different sources in an automated manner, document verification via OCR technology, and connecting with or communicating with borrowers digitally.

For instance, the automated systems can record, capture, and verify the borrower’s information instantaneously against predefined criteria, which in turn massively reduces the times used in processing.

According to a report from McKinsey, leading banks have reduced the “time to yes” from weeks to minutes and the “time to cash” from weeks to less than 24 hours by embracing digital lending processes.

2. Improves Accuracy

Eliminating manual entry of data helps reduce the risk of errors and ensures consistent and accurate data throughout the workflow which helps improve the overall quality of the loan portfolio and reduces the likelihood of loan denials or delays due to inaccurate information. Therefore, it helps provide improved customer satisfaction and experience.

3. Faster Processing Times

Automation of routine tasks at each phase, like data entry and document verification, for instance, improves loan origination. It allows for speedy decisions and consequentially quick loan approval and disbursal.

For instance, an AI solution can auto-extract and validate data in bank statements or loan documents, reducing the time spent handling these activities.

4. Enhances Customer Experience

It creates a better borrower experience due to the streamlined and automated process. Applicants will be able to submit documents much faster and get real-time updates on their applications. Faster decision-making can provide higher levels of customer satisfaction and loyalty.

According to a PwC study, 82% of customers want seamless and faster digital experiences from financial services. Banks implementing automated loan origination systems have increased customer satisfaction by 30%, using quicker processing and real-time updated notices.

5. Scalability and Growth

Practically all of the automation solutions developed are scalable to enable lenders to process a greater volume of loans without substantially increasing or relying on resources. For any lender who wants to build their business efficiently, scalability is indispensable.

Strategies to Increase Commercial Loan Origination Efficiency with Automation

With the change in the landscape of commercial lending mostly due to the emergence of more tech-enabled competitors, banks and financial institutions are adopting automation methods in their loan origination process to drive efficiency. However, competition is not the only driver for this shift towards automation.

Below we have mentioned some advanced automation strategies to improve commercial loan origination efficiency.

1. Implement Artificial Intelligence and Machine Learning

AI and ML can significantly automate and improve different aspects and areas of the commercial loan origination process. According to McKinsey & Company, the adoption of AI in lending can reduce the cost of loan processing by up to 40% by automating tasks such as data entry and document verification

These include:

- Predictive Analytics

It involves utilizing advanced machine learning algorithms to analyze historical data and predict the behavior of borrowers.

As a result, lenders can make a better-informed credit decision. If banks and financial institutions want to stay ahead, they should consider better approaches and advanced algorithms that can help deliver better predictions. - Automated Credit Scoring

Artificial intelligence can help analyze large data sets to identify patterns indicative of risks and evaluate creditworthiness more quickly and accurately. These technologies and advanced algorithms are increasingly powerful and promising in the context of credit risk quantification.

A recent report by Celent found that 75% of lenders are currently using or planning to use AI for collection management within the next two years.

- Fraud Detection

AI and machine learning combined with advanced analytics can help detect unusual patterns and red flags indicative of potential fraud automatically based on patterns and suspicious activities in real-time. This can help lenders significantly reduce the risk and ensure compliance.

A report by Javelin Strategy & Research estimates that lenders lost $34 billion to fraud in 2022.

2. Robotic Process Automation (RPA)

RPA can automate several activities or tasks that are relevant yet repetitive and rule-based, thereby enhancing efficiency from loan origination to document processing and quality control, billing, and customer satisfaction.

When combined with the cognitive abilities of AI and Machine Learning, lenders can upgrade RPA to achieve tangible results by further streamlining workflows, increasing efficiency, and supercharging productivity.

By automating up to 40% of non-core, manual tasks, lenders can enhance operational efficiency and reduce costs. Also, A recent Deloitte report indicates that 82% of lenders anticipate that Robotic Process Automation (RPA) will have a substantial impact on the lending industry within the next five years.

- Data Entry and Document Management

RPA aids in extracting data from disparate sources, populating the same across the loan origination system, and managing document workflows with limited manual intervention. - Compliance Checks

Automating compliance-related activities, for example, anti-money laundering and know-your-customer checks to meet regulatory requirements without manual effort.

3. Optical Character Recognition (OCR)

Optical Character Recognition (OCR) technology can help speed up loan decisions by converting various types of documents, such as paper documents that have been scanned, PDF files like tax returns, or an image taken by a digital camera, into editable and searchable data, thus letting underwriters and analysts slice and dice the data any way they want.

This technology has been reported to reduce cost by 30% and increase invoice processing accuracy by up to 95% – Forrester Research.

- Document Verification

It automates document verification of tons of documents, be they IDs, financial statements, or contracts, making the verification process quicker and error-free. - Automated Data Capture

OCR technology can capture data from loan forms and other documents to validate data, eventually saving time without compromising on accuracy.

With natural language processing and machine vision, this can be further improved to scan and extract data from loan documentation, assess borrower’s creditworthiness, and make lending decisions. A report by Forrester Research found that the global market for AI-powered document scanning is expected to reach $15 billion by 2027.

4. Integration of Low-Code Platforms

Low-code platforms provide access to the current banking system and data sources using out-of-the-box connectors to popular third-party APIs. This enables fast application development with little hand-coding needed, thus rapidly deploying loan origination applications that will help automate and streamline processes.

- Customizable Workflows

Design and edit workflows fast without extensive coding to keep up with the constantly changing business needs and environment. - Seamless Integration

Integrate various systems with multiple databases using minimal coding and allow seamless data flow and communication across the different dimensions of the loan origination process.

5. Cloud-Based Solutions

Flexibility, scalability, and accessibility—these are some of the advantages of cloud-based solutions that are essential for modern loan origination systems.

- Scalability

Easy to scale up or down with changing demand without wide-ranging infrastructure changes. - Real-Time Access

Anywhere, anytime access to loan origination data and applications allows for better collaboration and decision-making. - Disaster Recovery

Also ensures data security and business continuity through the built-in disaster recovery and backup solutions.

6. Enhancing User Experience with Digital Portals

Banks and NBFCs can leverage digital portals that offer an intuitive and user-friendly interface for borrowers to interact with the loan origination system. This will help them in enhancing overall experience and satisfaction for both lenders and customers.

- Self-Service Options

Enables the borrowers to upload and submit documents for loan applications and track their loan status online. - Automated Updates

Automates notifications and loan status updates to the borrowers throughout origination, thus keeping them informed and engaged.

Conclusion

Commercial loan origination integration with automation is not a technological upgrade but a strategic necessity if lenders want to win today in the marketplace.

With intelligent automation in loan origination, financial institutions can overcome the challenges in traditional methods, streamline processes, reduce errors, and enhance the borrower experience. Besides, embracing such technologies will continue to set the bedrock for any growth sustained by operational excellence.

To learn more about automation in commercial loan origination, you can reach us at info@anaptyss.com