Stress testing evaluates financial institutions' resilience against adverse conditions to identify vulnerabilities and prepare for economic shocks. Traditional techniques like scenario analysis and sensitivity analysis are limited by their static nature. Modern methods, such as machine learning, Monte Carlo simulations, and climate stress testing, offer greater flexibility, accuracy, and adaptability, enhancing risk management and decision-making.

Stress testing is a simulation technique crucial to test or assess the resilience of financial institutions and their portfolio or sub-portfolio against adverse conditions. Its purpose is to find vulnerabilities and prepare organizations for unexpected economic shocks. Stress testing helps financial institutions measure investment risks and asset adequacy and evaluate internal controls and processes.

Regulators obligate financial institutions to regularly conduct stress testing to evaluate their resilience in different stress scenarios that might impact borrower credit quality and the financial institution’s stability and health.

This blog discusses traditional stress testing techniques in credit risk management, explores their limitations, and outlines modern stress testing techniques for effective credit risk management.

Traditional Techniques in Stress Testing

The 2008 financial crisis led to more stringent regulatory reporting requirements, mainly due to the Dodd-Frank Act (2010), bringing focus on capital adequacy and stress testing. Currently, the BASEL III endgame, slated for implementation by 2025, necessitates documentation of banks’ capital level and administration of stress tests in various scenarios.

Below are some traditional stress testing techniques that banks and financial institutions employ to assess their resilience and the impact of risk factors on stability.

1. Scenario Analysis

Scenario analysis involves generating hypothetical scenarios that can negatively influence the credit portfolio. Typically, these involve economic downturns, changes in regulatory requirements, and natural disasters. Financial institutions develop these scenarios based on historical data and expert opinion. It helps understand the following:

- Effect of changes in interest rates.

- Exchange rates or commodity prices.

For instance, financial institutions can use scenario analysis to determine the impact of a 1% rise in interest rates on their credit portfolios. Scenario analysis is simple to implement and understand and provides a clear view of the possible impact of individual risk factors under defined conditions.

However, the scenarios usually are based on historical data and hence may not be relevant in forecasting future occurrences. Thus, it may not be adequate in covering all the possible risks or real-world scenarios.

2. Sensitivity Analysis

Sensitivity analysis evaluates the changes in some variables on the credit portfolio.

It relies on single variables, such as interest rates or unemployment, that are incrementally changed to observe the impacts and identify the consequences.

Sensitivity analysis allows for the identification of key risk drivers and conducting a deep analysis of isolated variables. However, it relies on individual variables—with no interplay among them —and therefore, many systemic or interconnected risks can remain undetected.

3. Historical Scenarios

Historical Scenarios use past financial crises or adverse events to model the potential impact on current financial positions. Historical scenarios help develop scenarios using the historical data to reflect conditions similar to past events.

They rely on actual events, which, in turn, assist in providing realistic and relevant insights and understanding of how institutions addressed past crises.

For instance, financial institutions may analyze the effect of a specific type of monetary crisis, as that witnessed in 2008, on the existing asset portfolio. Nonetheless, they are historical incidences and may not be used to predict future. The quality of historical data also limits this technique.

4. Value-at-Risk (VaR) Stress Tests

The VaR stress test expands traditional VaR analysis by stressing portfolios with extreme yet plausible scenarios that allow assessing potential losses under such adverse conditions.

It is quantitative and thus is well used and accepted in the financial industry. For instance, commercial banks typically use VaR stress tests to analyze the losses that may likely occur in their trading portfolios under severe market disturbances.

However, this technique assumes normal market conditions, which may not hold valid in extreme scenarios, underestimating risks if such extreme events fall outside the modeled scenarios.

5. Liquidity Stress Testing

Liquidity stress testing evaluates the organization’s ability to fulfill short-term obligations under adverse conditions. It models situations that envision sudden withdrawals of deposits or the inability to refinance short-term debt.

The technique helps institutions maintain their liquidity buffers for managing short-term financial stability. For example, a bank can simulate a 30% withdrawal of customer deposits within a week to check the impact on liquidity.

However, financial institutions may require advanced modeling to make proper simulations for practical simulations of liquidity events. Advanced modeling is crucial since assumptions made in the scenarios might significantly affect the results.

6. Regulatory Stress Tests

Financial regulators impose regulatory stress tests on banks to check their resilience against risk types under systemic conditions. Typically, regulatory authorities design multiple scenarios to evaluate a wide range of possibilities. The exercises support establishing benchmark resilience across various firms and maintaining effective surveillance for compliance with regulatory standards.

Examples include the Federal Reserve’s CCAR stress tests for large U.S. banks.

However, regulatory stress tests may prove to be an extraordinarily resource-intensive and expensive exercise in implementation. Additionally, scenarios are predefined and may not encompass all the specific risks individual institutions face.

Limitations of Traditional Techniques

The conventional stress test methods pose the following limitations:

- They are typically non-comprehensive since they predict events based on static, predefined scenarios. This way, they cannot predict all possible unforeseen events. This static nature also bars them from dynamically adapting to new information or emerging risks.

- Traditional methods usually lack the integration of a wide variety of data sources, which diminishes the ability to present a composite view of potential credit risks.

Modern Techniques in Stress Testing

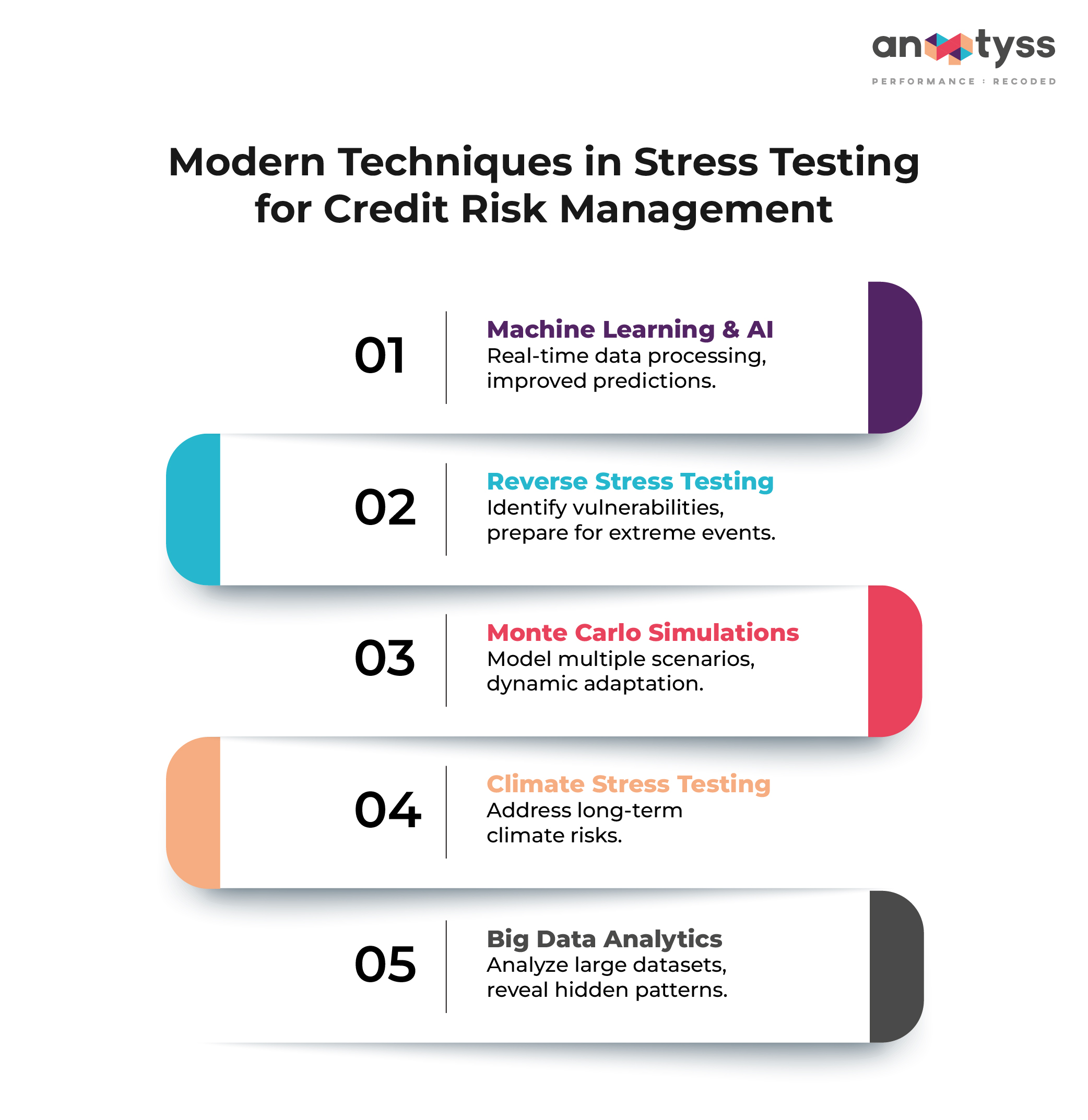

Over the years, stress testing methods have advanced significantly and use more sophisticated technologies and methodologies to assess the resilience of financial institutions and systems under adverse conditions. Some modern stress testing techniques for credit risk management include:

1. Machine Learning and AI-based Models

Machine learning and AI-based models have revolutionized stress tests as they enable financial institutions to analyze massive sets or volumes of data in real time. These technologies can efficiently recognize patterns and predict outcomes more accurately than traditional methodologies.

Advantages:

- Real-time data processing and analysis

- Improved predictive analytics capabilities

- Capability to evolve from new or additional data and self-learning

2. Monte Carlo Simulations

Monte Carlo simulation is a mathematical technique applied to estimate Credit Value at Risk (CVR) and the economic capital of credit portfolios held by the financial institution. It can forecast a possible outcome of an uncertain event by using past data using probabilistic techniques, random sampling, and choice of action. It offers the flexibility to develop dynamic scenarios in a more comprehensive way for testing against potential risks.

Advantages:

- Can model multiple/vast array of scenarios

- The probability-based analysis provides a more detailed resolution to the risk assessment

- Dynamic and very sensitive to new information

3. Integration of Big Data Analytics

Big data technology employs advanced techniques to process colossal and complicated datasets. This approach helps improve the ability to assess credit risk by using a wide range of data sources that could include non-traditional or unstructured data, such as social media trends, billing history, transaction patterns, and more.

Advantages:

- The quality of data sources improves risk assessment accuracy

- Accurate risk assessment in large datasets

- Can discern hidden patterns and correlations

4. Reverse Stress Testing

This advanced risk management technique starts from a given outcome to specific products, for example, a significant financial loss or failure. It goes backward to extract possible scenarios or events that might lead to a given outcome. The technique allows financial institutions to incorporate extreme and plausible events and their effect on operations and solvency.

Advantages

- Helps identify vulnerabilities and potential points of failure that may not be visible in traditional stress testing

- Enables financial institutions to prepare themselves for extreme but low-probability events to improve risk resilience

5. Climate Stress Testing

In contemporary times, factoring and preparing for climate risks is essential. This technique helps the financial institution assess the potential impact of climate change risks, considering events such as rising temperature and sea levels and how regulatory changes will affect the institution’s portfolio and economic well-being.

Advantages

- Helps address long-term risks linked with climate change and prepare institutions for upcoming environmental shifts

- Meet regulatory changes and requirements focused on climate risk

- Allows financial institutions to have a comprehensive view of the impact of climate risks on investments and operations

Advantages of Modern Techniques Over Traditional Ones

Modern stress-testing techniques offer several advantages. Some of these include:

- They can enhance flexibility and adaptability, allowing financial institutions to respond effectively to emerging risks.

- Modern techniques offer better accuracy and predictability, enabling more reliable credit risk assessment.

- Real-time analysis and reporting enable quicker decision-making and more proactive risk management.

Modern techniques present a more comprehensive and detailed view of potential risks and enhance the institution’s ability to withstand adverse conditions.

Conclusion

As financial markets grow in complexity, the limitations of traditional stress testing methods become more apparent. Modern techniques employing machine learning, AI, Monte Carlo simulations, and Big Data Analytics improve the accuracy, flexibility, and comprehensiveness of stress testing.

These advancements allow financial institutions to predict and manage credit portfolios and credit risks more effectively, ensuring greater resilience against economic shocks.

Anaptyss offers state-of-the-art tools and technologies, including the latest techniques in modern stress testing, to help financial institutions get the necessary insights for navigating a continually evolving industry landscape.

To learn more, write to us at: info@anaptyss.com