Banks and other financial institutions use models for credit scoring, fraud detection, pricing financial instruments, and managing risk. As models become more complex and integral to banking operations, the potential for errors and losses also increases. This gives rise to different types of model risks due to inaccurate or poorly devised models to make decisions.

Model Risk Management (MRM) is therefore crucial for banks to address regulatory demands and operational challenges while improving decision-making. Banks are also shifting towards a more efficient and value-focused model risk management approach due to the growing reliance on models, regulatory pressures, and shortage of skilled talent.

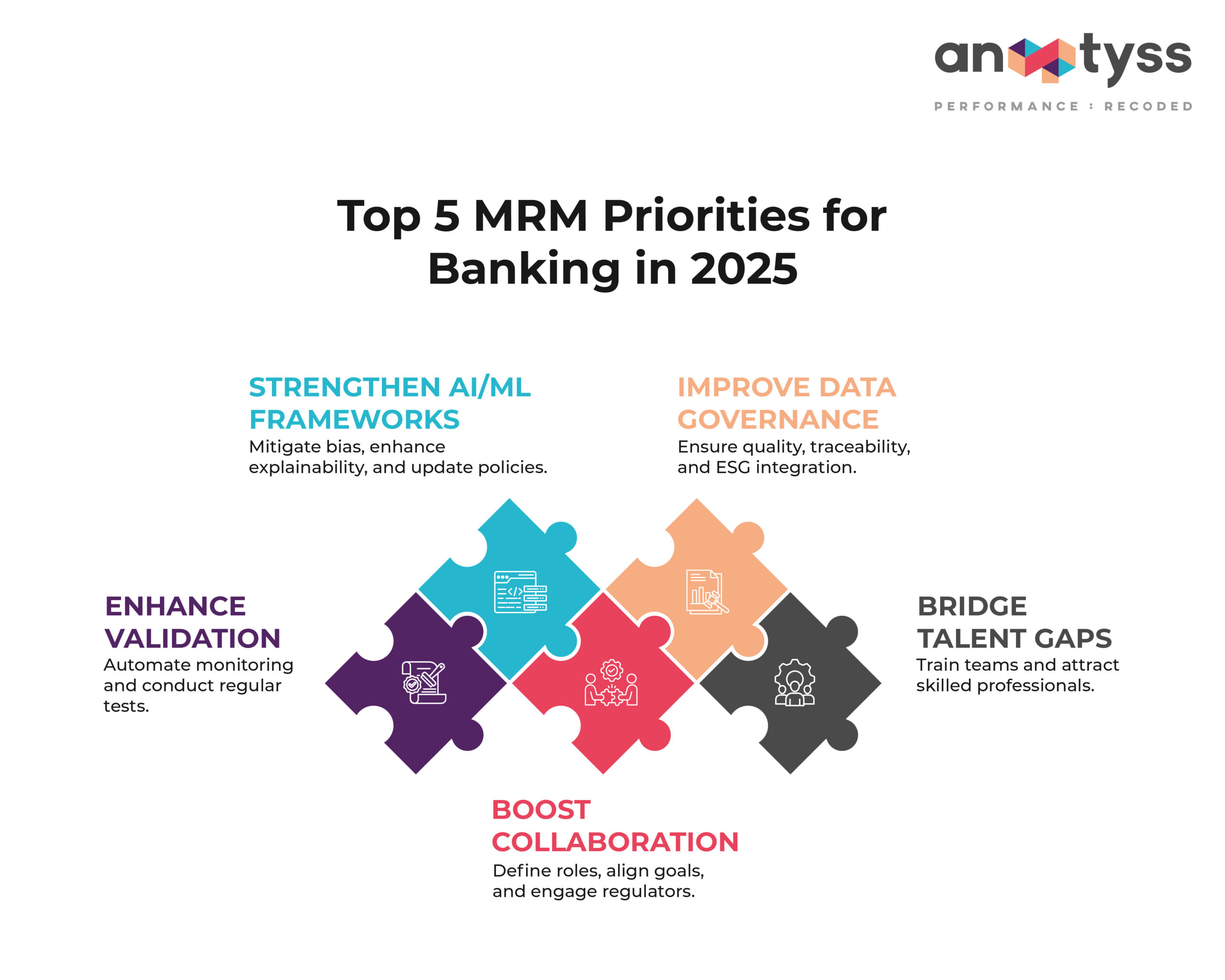

As we approach 2025, this blog post outlines the top five MRM priorities that should be on the radar of every bank executive in the coming year.

1. Enhance MRM Frameworks Using AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the banking industry by enabling them to intelligently automate processes, personalize customer experiences, and gain deeper insights from data. However, these technologies also introduce new challenges for MRM. Traditional Model Risk Management frameworks may not be sufficient to address the unique risks associated with AI and ML models, such as:

- Bias

- Explainability

- Robustness

In addition, the regulatory landscape for MRM is constantly evolving, with guidelines like SR 11-7 providing a comprehensive framework for model risk management in the US. Furthermore, international standards like Basel III emphasize the importance of robust MRM practices for maintaining financial stability. These regulations require banks to establish comprehensive MRM frameworks, conduct rigorous model validation, and ensure ongoing monitoring of model performance.

Key Steps for Bank Executives:

- Update MRM policies and procedures.

Revise existing MRM frameworks to specifically address the challenges of AI and ML models, incorporating guidelines for model development, validation, and monitoring.

- Invest in AI/ML expertise.

Develop in-house expertise or partner with external vendors or managed service providers to gain the necessary skills and knowledge to effectively manage AI/ML model risk.

- Address ethical considerations.

Develop guidelines and controls to mitigate potential biases in AI/ML models and ensure fair and transparent decision-making. Failing to manage AI and ML model risk effectively can damage a bank’s reputation and erode customer trust.

2. Strengthen Data Quality and Governance

Data is the foundation of effective MRM. High-quality data is essential for developing accurate and reliable models, while robust data governance ensures data integrity, security, and compliance with privacy regulations.

Key Steps for Bank Executives:

- Establish a data governance framework

Implement a comprehensive data governance framework that covers data quality, lineage, security, and access control.

- Invest in data quality tools and technologies

Utilize data quality tools and technologies to cleanse, standardize, and validate data used in models.

- Ensure data lineage and traceability

Maintain clear documentation of data sources, transformations, and usage to ensure data traceability and accountability.

- Comply with data privacy regulations

Implement measures to protect customer data and comply with relevant privacy regulations, such as GDPR and CCPA.

- Address ESG Data

The increasing adoption of Environmental, Social, and Governance (ESG) models in banks requires careful consideration of ESG data quality and relevance. Banks need to ensure that ESG data is accurate, reliable, and aligned with the bank’s sustainability goals. Poor data quality can lead to inaccurate model predictions and flawed business decisions, highlighting the crucial link between data quality and model accuracy.

3. Improve Model Validation and Monitoring Processes

Model validation and monitoring are crucial for identifying and mitigating model risk throughout the model lifecycle. Effective validation ensures that models are fit for purpose and perform as expected, while ongoing monitoring detects performance deterioration and emerging risks.

Key Steps for Bank Executives:

- Implement independent validation

Establish an independent validation function to provide objective assessments of model accuracy, reliability, and limitations.

- Conduct regular model reviews

Implement a schedule for regular model reviews, including backtesting, sensitivity analysis, and stress testing, to assess model performance and identify potential weaknesses.

-

- Stress testing to evaluate model performance under extreme or adverse economic conditions to assess its resilience and identify potential vulnerabilities.

- Sensitivity analysis to examine how changes in model inputs or assumptions affect the model’s outputs, helping to understand the model’s behavior and identify key drivers of risk.

- Back-testing for comparing model predictions to actual outcomes to assess the model’s accuracy and identify potential areas for improvement.

- Utilize model monitoring tools

Leverage technology solutions to automate model monitoring and alert management, enabling timely detection of performance issues and risk mitigation.

- Enhance documentation and reporting

Maintain comprehensive model documentation and reporting to ensure transparency and facilitate effective communication with stakeholders.

- Explore RPA Implementation

Consider the potential benefits and challenges of implementing Robotic Process Automation (RPA) in MRM. RPA can automate repetitive tasks, improve efficiency, and reduce errors in model validation and monitoring processes. However, careful planning and implementation are crucial to ensure successful RPA adoption.

4. Address Talent and Skill Gaps

The increasing complexity of models and the growing adoption of AI and ML require specialized skills and expertise in MRM. Banks need to address talent gaps and invest in training and development to ensure they have the necessary capabilities to manage model risk effectively.

Key Steps for Bank Executives:

- Identify skill gaps

Conduct a comprehensive assessment of existing MRM skills and identify areas where training and development are needed.

- Invest in training programs

Develop and implement training programs to enhance MRM knowledge and skills, including areas such as model validation, AI/ML risk management, and data governance.

- Attract and retain talent

Implement strategies to attract and retain skilled MRM professionals, including competitive compensation and benefits packages and opportunities for career development.

- Foster a culture of learning

Encourage continuous learning and knowledge sharing within the MRM team to promote innovation and best practices. Banks with strong MRM talent can gain a competitive advantage by making better decisions related to capital allocation and improving their overall operational efficiency.

5. Enhance Communication and Collaboration

Effective communication and collaboration are essential for successful MRM. This includes clear communication of model risk appetite, roles and responsibilities, and model performance to both internal and external stakeholders.

Key Steps for Bank Executives:

- Clearly define roles and responsibilities

Establish clear roles and responsibilities for model development, validation, monitoring, and reporting.

- Communicate model risk appetite

Clearly articulate the bank’s risk appetite for model risk to ensure alignment between business objectives and risk management practices.

- Establish regular reporting mechanisms

Implement regular reporting mechanisms to communicate model performance, risk exposures, and mitigation strategies to senior management and the board of directors.

- Engage with regulators

Maintain open communication with regulators and proactively address any concerns or questions regarding MRM practices. Discover More – A Comprehensive Guide to Model Risk Management For deeper insights into the challenges, solutions, and emerging trends in Model Risk Management, download our white paper Model Risk Management in Financial Services: Challenges, Solutions, and Trends. This white paper delves into governance, AI integration, transparency, and more—critical for staying ahead in today’s regulatory and technological landscape.

Conclusion

As the banking industry continues to evolve, MRM will play an increasingly critical role in ensuring the safety and soundness of financial institutions. By prioritizing these top five MRM priorities, bank executives can effectively manage model risk, enhance decision-making, and maintain a competitive edge in the dynamic banking landscape of 2025 and beyond.

Anaptyss partners with financial institutions to navigate the model complexities, offering innovative solutions and expertise to build robust, future-ready MRM frameworks that ensure compliance, resilience, and operational excellence. To learn more, reach us at info@anaptyss.com